IPEM Cannes 2024 – The Daily Spin – January, 25th

The shifting role of LPs was the overarching theme for the morning session of Day 2, at the 10th edition of IPEM in Cannes. After a full day of yoga,…

Private market investors have seen an extended period of deal activity over the last decade but the investment optics have changed in 2023. Higher rates, inflationary pressures, and volatile markets, have generated uncertainty and impacted deal volumes. As Bain & Company point out in their 2023 mid-year PE report, “uncertainty is the enemy of dealmaking”.

They note that through the first six months of the year, global buyout funds oversaw 863 deals and $202 billion in deal value. This is a 58% fall on the same period last year. In Europe, VC deals have fallen even more sharply; down 60% compared to the first half of 2022 according to Pitchbook.

Raising the bar?

With an estimated $2.8 trillion in unrealised assets, buyout funds must also grapple with a challenging exit environment, as they aim to generate much-needed distributions to their LPs. Global private equity exits in the year to Sept 30th totalled 1,294. This is some way off last year’s full-year aggregate of 1,584 exits. Whether it is doing deals on the way in, or the way out, 2023 has been a testing period.

All of which will require LPs to look closely in 2024 at how effective PE firms are at sourcing the right opportunities, as well as continue to create new liquidity routes. Arguably, the bar has risen in terms of how LPs look at managers’ track records and their ability to increase the multiple on invested capital.

“As the cost of capital is higher and capital is scarcer – investors allocating less because of the denominator effect or because of liquidity issues (fewer DPIs being made) – then mathematically you could say the bar is getting higher,” comments Jean-Francois Le Ruyet, Partner at Quilvest Private Equity in London where he sits within the funds and co-investments team. He continues: “Investors are allocating less capital to fewer funds. That has been the direction for 2023 and I think it will continue for at least the first half of 2024. Even if the market turns and IPOs come back in force, it will take time to translate in to more distributions.”

One of the topics of discussion on Day 2 at IPEM Cannes 2024 will be “Exploring track records: What’s a successful deal for LPs?”

Independents Day

Allocators remain picky “and are more cautious, they are not rushing in to anything”, says one European LP. As opposed to committing capital to blind pools, allocators want to see seeded or pre-seeded portfolios. The challenge for GPs, therefore, is to have a first tranche of investors in place and show deals to prospects while they continue to fund raise.

Moreover, LP are scrutinizing unrealized portfolio investments far more than they were in the past. “Are the valuations being reported accurate? What is the basis for that valuation and what is the outlook for that particular company? There is a degree of skepticism among LPs,” opines Le Ruyet.

This is creating an interesting new dynamic in European PE dealmaking: the rise of the independent or ‘fundless’ sponsor: that is, private equity teams doing deals without a fund, and finding backers. While more established in the US, it is fast gaining traction in Europe.

Headway Capital Partners, a liquidity specialist and active co-investment and secondaries investment firm, has a particular interest in this part of the market.

“Most of what we are doing is backing fundless sponsors on a deal by deal basis,” explains Managing Partner, Christiaan de Lint. “With fundless sponsors, you can create full alignment with teams and businesses. The deals have to work because their futures depend on it.”

This is gaining a lot of momentum right now because of issues in the fundraising market and as de Lint adds: “I expect it to continue. It’s a little bit like secondaries in the 1990s: nobody heard about them until the dotcom crisis and once everyone knew about them, it stayed that way. The three sectors we are most active in are industrial, business services and healthcare services.”

Germany and the UK are fertile markets for investors to explore such deal opportunities, particularly the UK which is home to many well-established independent sponsors.

Such an approach could help address the pre-seed point made above, as it gives PE professionals the opportunity to show potential investors their dealmaking prowess, before formalizing a fund structure.

Allow me to continue

It is worth noting that this is different to the co-investment space; a much larger market where GPs offer investors additional economics by investing in firms above and beyond their fund commitments. This year’s challenging fundraising environment has pushed GPs to offer co-investments. However, a lack of distributions means that LPs have less capital to invest in new funds, let alone co-investments. “That means it is hard for GPs to get deals done. This further lowers exit activity and it becomes a vicious circle,” suggests de Lint.

As PE deal parameters change to the prevailing economic conditions, secondary market deals are becoming an increasingly prominent feature, with GP-led deals, or ‘continuation vehicles’, providing an effective way for PE managers to retain ownership of trophy assets while also offering their LPs a liquidity exit.

The afternoon panel session at IPEM Cannes 2024, “Continuation Funds – a new way to do deals?” will provide up-to-date insights on this topic.

Quilvest Capital Partners announced on 5th December 2023 the closing of Summa Circular, an Article 9 continuation fund, in partnership with Summa Equity. The asset is NG Group (“NG”), a leading Nordic provider of circular solutions and environmental services, a firm acquired initially by Summa Fund I in 2018.

“This is an asset we’ve known for many years,” comments Le Ruyet. “It’s a well-managed resilient firm. It offers us a green tech narrative on top of the investment thesis. Impact and performance are important to us.”

Pantheon’s announcement that it had closed Pantheon Global Secondaries Fund VII with $3.25 billion – exceeding its initial target of $2 billion – underscores the importance of secondary deal activity today.

Liquidity drives deal flow

Pantheon notes that continued demand for liquidity from both investors and fund managers is driving increased deal flow and attractive pricing, particular in the mid-market.

“This latest fund will be a 50/50 allocation to GP-led and LP-led deals,” confirms Petra Bukovec, a Partner in Pantheon’s global secondaries team. “We also have a separate GP-led fund that focuses only on single asset secondary transactions. There continues to be an under-capitalization for GP-led transactions. Fundraising hasn’t necessarily kept up with increasing supply of transactions and that is making it a very attractive market.”

Bukovec notes that not all GP-led deals end up getting completed but if there is a clear rationale to continue with the strategy and an alignment of interests, “then it presents a good case to use a continuation vehicle.”

One future trend that is worth considering is the emergence of a ‘continuation fund of a continuation fund’ where the GP has already established one of these vehicles and wishes to extend the investment period even further and move it in to a new fund.

“If an asset is sold four times in a row, and each time you make a 3x return, then of course people are going to think it makes sense to keep hold of it, and offer liquidity back to LPs (at each stage). You can imagine scenarios where this happens. But there would come a stage where the GP can no longer get additional economics,” suggests de Lint.

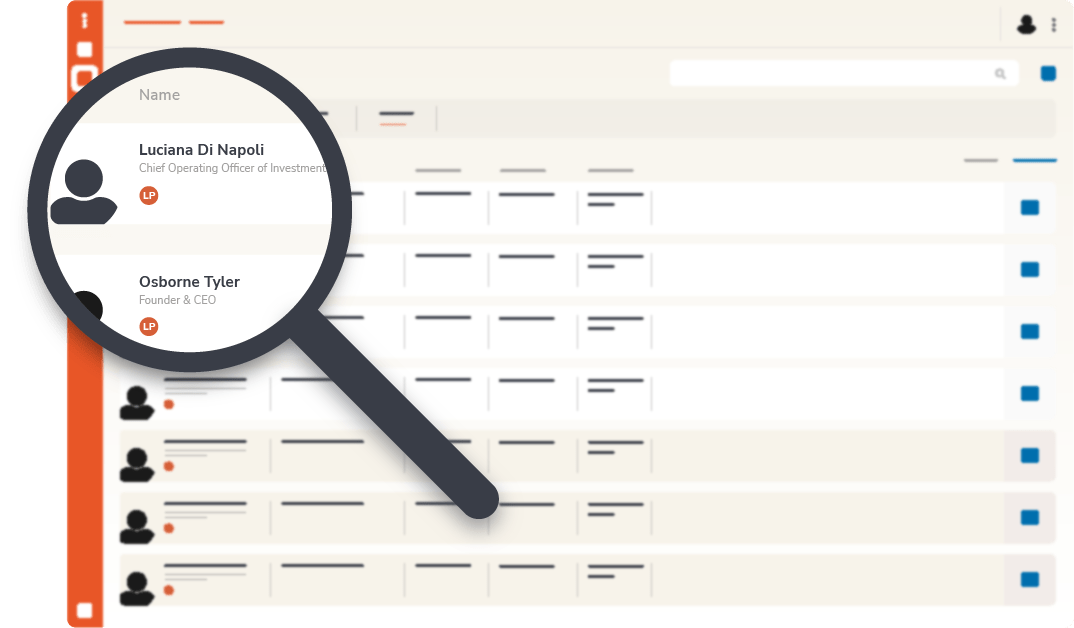

Investors are taking a more data-driven approach to assessing both managers and the underlying portfolio firms, which is likely to place even greater importance on the quality of dealmaking; which GPs are truly delivering outperformance? This topic – “The data-driven LP” – will be explored during the afternoon of Day 2 at IPEM Cannes 2024.

“Due to our large platform, which invests across primaries, secondaries and co-investments, we have a huge amount of data, both qualitative and quantitative,” says Bukovec. “Our secondaries strategy focuses on relationships with GPs that we know and on whom we have better information. When you have concentrated positions, diligencing companies from the bottom up is very important. For diversified LP fund positions, the data-driven approach can be even more relied on. It is a continuing development for us, and probably the rest of the market.”

At Headway Capital, de Lint confirms they are already using a number of AI tools. “Anyone who is not seriously looking at this data-driven approach is going to be at a disadvantage. It won’t replace what we do, but it’s a very useful tool. Used well, it will be a fantastic support,” he concludes.

☑️ Maximize Your Networking Potential:

Tap into advanced tools for seamless connections. Use our innovative algorithm for perfect matches within the industry.

☑️ Unrivaled Event Preparation:

Plan meetings, access the participants’ list, and customize your agenda effortlessly.

☑️ Stay Informed, Stay Ahead:

Real-time updates, offline event program, and all info in one place.

☑️ Experience the Power of Collaboration:

Engage with the private equity community.

☑️ High-quality connections using our affinity algorithm.

☑️ Filter opportunities to minimize irrelevant solicitations.

☑️ Manage communications with our secure email system.

☑️ Access exclusive reports, replays, photos…

☑️ Maximize your event experience.

The shifting role of LPs was the overarching theme for the morning session of Day 2, at the 10th edition of IPEM in Cannes. After a full day of yoga,…

Fill-in the information below to submit your event.

Fill in the information below to download the Survey.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the Investor Package.

Fill in the information below to register as a journalist.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the list of firms.

Fill in the information below to download the LP Package.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Wealth Discovery Package.

Fill in the information below to download the IPEM Playbook – Navigating the Wealth Revolution.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Full Report.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the IPEM LP Package 2025.

Fill in the information below to download the Program.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the Factsheet.