IPEM Cannes 2024 – The Daily Spin – January, 25th

The shifting role of LPs was the overarching theme for the morning session of Day 2, at the 10th edition of IPEM in Cannes. After a full day of yoga,…

Cannes 2024 promises to be a unique occasion as IPEM celebrates the 10th edition of its private markets event. Delegates will have the chance to gather at the Grand Opening Party, a special pre-event cocktail, on January 23rd, to kick off the three-day event in style. Approximately 3,000 delegates are expected, including 400 GPs, 400 LPs, and over 1,000 investment firms.

IPEM’s roots are in Cannes, where it all started in 2016 with 400 attendees. Fast forward to IPEM Paris 2023, which welcomed over 6,000 delegates, and the arc of growth has been significant; mirroring the growth of private markets, whose total AUM was circa $12 trillion at the end of 2022.

Cannes 2024: Where Deals Take Center Stage

Whether private markets can continue their impressive ascent and play a bigger role in financing the real economy (flipping roles with public markets) will, to some extent, depend on how effective GPs are at putting capital to work in a ‘higher for longer’ rate environment. According to Pitchbook, in 1H23, European VC deal value was down 60% compared with 1H22, while in private equity, global buyout deals are heading for a 40% decline.

Consequently, the theme of Cannes 2024 is “Getting Deals Done”. With GPs under pressure from investors to put capital to work, and successfully exit investments to lock in realized returns, the agenda has been designed to foster meaningful debate among industry practitioners.

Every private market asset class, from VC and PE to private credit and infrastructure, will be covered, from a ‘deal dynamics’ perspective. Private credit, in particular, has seen tremendous growth in recent years with a total AUM in excess of $1.5 trillion. And while lending opportunities to both sponsored and non-sponsored corporates remain healthy, private credit managers will need to carefully consider the risks if, as expected, loan defaults begin to tick up in 2024.

Part of the reason why deal activity is challenged is the extent to which financing costs have risen in the last two years, requiring GPs to commit more equity; leverage is lower and more expensive. This is playing to the advantage of private credit funds, as GPs look for alternative financing options beyond the syndicated loan market. But even private credit funds will need to be careful about which deals they back in 2024, as the industry watches for signs of corporate stress and loan defaults.

“Valuation resets will be an important aspect of the discussion. How will this influence future deal-making?” comments Antoine Colson, CEO and Managing Partner at IPEM.

Will there be more distressed companies, creating attractive M&A opportunities? And if so, which sectors might be the best considerations?

GPs will likely need to focus attention on how they approach deal structuring, as they consider new ways to innovate. It will be a key aim of Cannes 2024. Will the industry see more corporate carve-outs and more add-on acquisitions?

“We want to provide a platform for dealmakers who have been particularly active in recent months, and allow them to discuss how they’ve approached getting deals done in this environment,” adds Colson.

Evidence of the fact that GPs are pushing the innovation envelope to source and execute deals can be seen in the launch of firms such as US-based Clipway. The investment firm has developed a proprietary Technology-Enabled Secondaries System (TESS) to optimize its investment strategy. Technology will arguably play an increasingly important role as GPs, more broadly, adopt digital tools to improve investment outcomes.

The investor’s view on what makes a good deal

Day 1 will open with the 2024 European PE Survey Presentation, in which an array of findings will be presented on European fund manager market sentiment. A perfect way to set the scene, as the industry kicks off a new year of investment activity.

As well as focusing on the deal landscape across different European jurisdictions including France and the UK, Day 1 will feature a broad range of GP-led discussions such as:

• Getting creative with deal sourcing strategies.

• Hunting for carve-outs.

• Will large deals be back in 2024?

In addition, there will be two dedicated summit rooms focusing on Deal Innovation, Infrastructure and Portfolio Transformation, as well as sector-specific sessions covering Technology and Software, Healthcare and Energy Transition. The latter two will feature on Day 2, where the focus of the program shifts to LP perspectives on the deal landscape.

What, in their view, does a successful deal (and dealmaker) look like? How do they think about value creation? Why is capital deployment so important right now? A wide selection of investors with a close view on deal dynamics, and who have been actively doing deals in 2023, will have the chance to share their views. These will include Family Offices and those who are actively doing co-investments, and/or have a growing interest in continuation funds.

Topics to look out for include:

• Exploring track records – What’s a successful deal for LPs?

• Continuation funds – a new way to do deals?

• How to deploy capital with a green agenda.

• The data-driven LP.

Part of the reason for IPEM’s success in Cannes is that it provides an opportunity for private market professionals to enjoy a genuine ‘off-site’ experience.

Decamp and embrace the Riviera “off-site” experience

The industry is able to decamp – whether that is from London, Paris, or Berlin – and gather in one special location. With everything in close proximity, from the Palais des Festivals to the hotels and IPEM social events, Investors, Advisors, and Fund Managers can connect from the moment they eat breakfast and/or enjoy a yoga session, to ordering their first cocktail of the evening. Where better place to discuss and ‘Get Deals Done’ than in the beguiling French Riviera?

Delegates will have the option to participate in yoga and running sessions on the mornings of January 24th and 25th. The IPEM Cannes 2024 Official Dinner (invitation-only), and Venture Party will feature on the evening of Day 1, while a last cocktail will close out the event on Day 2.

To add an additional element of connectivity, IPEM delegates will once again have the opportunity to reserve their seats on the IPEM Croisette Express, where the event truly starts, a specially chartered train that will run directly from Paris to Cannes.

The Croisette Express is a key feature of IPEM’s Going Green initiative and with approximately 510 seats available, it is a great way for GPs and LPs to relax and discuss some of the event topics ahead of the main plenary. It is also the first important networking opportunity where delegates will be able to participate in workshops organized by Indefi while enjoying a meal in the comfort of a high-speed train.

Watch the date

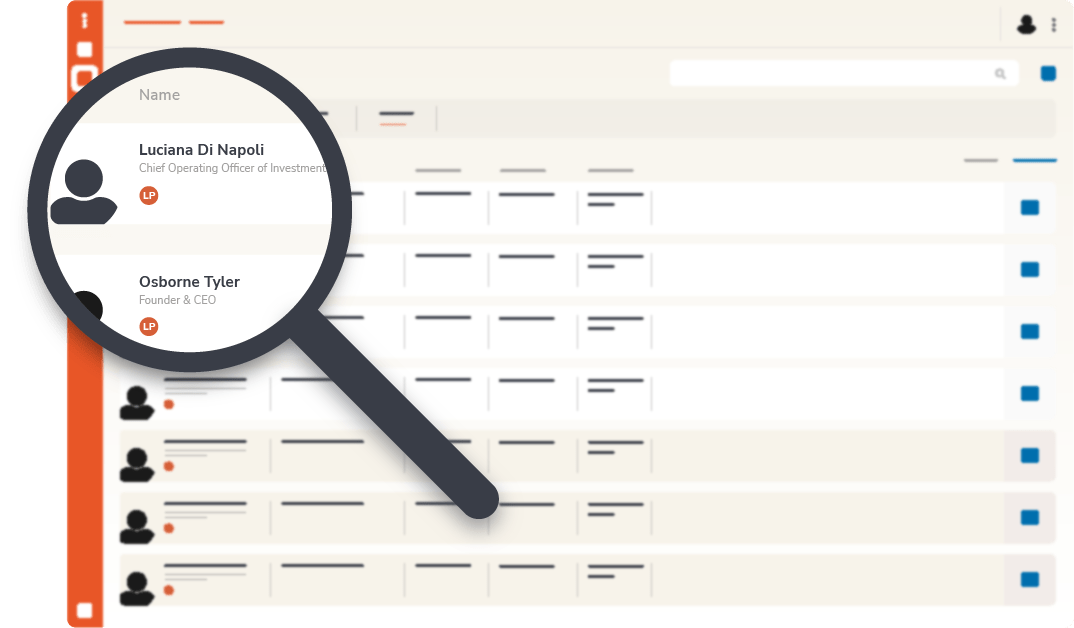

Two months before the event, delegates’ IPEM Accounts will be open for people to begin organizing meetings and filling their calendars. In the meantime, all relevant details pertaining to Hotel Bookings and reserving seats on the IPEM Croisette Express can be found on the main IPEM website.

So how does Antoine Colson feel as IPEM reaches its 10th edition?

“Back in 2016, we had 400 delegates for the first edition. With IPEM Paris 2023 and the upcoming 10th edition in Cannes, we expect 10,000 delegates to have attended. That’s a fantastic journey and something we have achieved thanks to a growing and energetic industry. We are thankful to the people who have pioneered IPEM and supported us along the way.“

“Still, life is not a calm river. We’ve lived through COVID, are we expect other hurdles to overcome in the future. We expect the 10th edition to be a great celebration and we’re looking forward to sharing it with the IPEM Community.”

☑️ Maximize Your Networking Potential:

Tap into advanced tools for seamless connections. Use our innovative algorithm for perfect matches within the industry.

☑️ Unrivaled Event Preparation:

Plan meetings, access the participants’ list, and customize your agenda effortlessly.

☑️ Stay Informed, Stay Ahead:

Real-time updates, offline event program, and all info in one place.

☑️ Experience the Power of Collaboration:

Engage with the private equity community.

☑️ High-quality connections using our affinity algorithm.

☑️ Filter opportunities to minimize irrelevant solicitations.

☑️ Manage communications with our secure email system.

☑️ Access exclusive reports, replays, photos…

☑️ Maximize your event experience.

The shifting role of LPs was the overarching theme for the morning session of Day 2, at the 10th edition of IPEM in Cannes. After a full day of yoga,…

Fill-in the information below to submit your event.

Fill in the information below to download the Survey.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the Investor Package.

Fill in the information below to register as a journalist.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the list of firms.

Fill in the information below to download the LP Package.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Wealth Discovery Package.

Fill in the information below to download the IPEM Playbook – Navigating the Wealth Revolution.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Full Report.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the IPEM LP Package 2025.

Fill in the information below to download the Program.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the Factsheet.

Fill in the information below to download the Product Catalog.

Fill in the information below to download the Investor Package.