January 28-30, 2025 – Palais des Festivals, Cannes, France

All the content about IPEM Cannes | Wealth 2025

Save the date for the NEXT IPEM Edition in Paris, on Sept. 24-26, 2025 - Palais des Congrès

Bringing together Private Markets and Wealth ecosystems

January 28-30, 2025 – Palais des Festivals, Cannes, France

Since 2016, IPEM Cannes has brought a different essence to the private capital industry by gathering its key decision-makers in a conducive environment for meaningful exchanges.

This year, the event will also incubate IPEM Wealth [NEW] – a brand-new format designed to support the democratization of Private Markets.

For the first time ever, IPEM is also recognizing the pioneers shaping the future of private capital with the IPEM Wealth Awards [NEW].

With its vibrant ecosystem, IPEM Cannes and the brand-new event IPEM Wealth provide the ideal platform for investors, fundraisers, dealmakers, and advisors to connect and make impactful deals – right on the French Riviera.

The EMEA best-in-class event to explore trends and insights of Private Markets

- High-level conferences to gain insights and learn from experts.

- Market intelligence sessions to capture trends and innovations.

- Workshops and sessions to explore the full potential of the PE democratization with The Wealth track!

- Summits to join the conversation on various asset classes (Infra & Real Assets, Private Equity, Private Debt, Venture & Growth).

- Breakout Rooms to stay ahead of emerging practices (Secondary, Healthcare…).

An Efficient Networking Experience within the PE and the Wealth ecosystems

- A marketplace with 300 exhibitors and sponsorship opportunities that drive connections and visibility.

- The enhanced online database to engage with 550 vetted LPs, 500 GP firms, 300 Advisors / Business Services and 250 Family Offices, Private Banks and Wealth Managers.

- The IPEM Croisette Express direct train from Paris to Cannes to network with industry peers.

- Dedicated events for peers like the LP welcome breakfast and the LPxVC lunch on Jan. 29th.

A Mediterranean Village Atmosphere fostering efficient connections

- The acclaimed destination for business events, accessible from Europe and beyond.

- The special French Riviera atmosphere to enjoy business with your peers.

- A unique Offsite experience designed for you with exclusive breakfasts, lunches, cocktails, dinners and networking events open to all delegates:

→ Grand Opening Party on Jan. 28th.

→ Morning Run on Jan. 29th & 30th.

→ The two IPEM Wealth Awards Celebrations with all IPEM friends by night.

Among the IPEM Cannes | Wealth 2025 Speakers

Biography

Josh Helfat is the Head of Private Investments for Global Alternative Investment Solutions at J.P. Morgan. He leads the team responsible for due diligence, manager selection and portfolio management for private equity, real estate, and credit fund investments for Global Wealth Management. Previously, Josh was part of the Private Bank Investment Strategy team, focusing on economic and investment analysis, and worked in the Financial Sponsor Group at J.P. Morgan’s Investment Bank. He began his career at Cambridge Associates, advising endowments, foundations, and high-net-worth families on asset allocation and portfolio management. Josh is a CFA® charterholder and holds an M.B.A. from the Tuck School of Business at Dartmouth and an A.B. in Economics and Government, cum laude, from Bowdoin College. He also serves on the Board of Trustees for The Town School in New York City.

Biography

Richard Hope is the Co-Head of Investments and Head of Europe, the Middle East and Africa (EMEA). In his role as Co-Head of Investments, he has broad leadership and management responsibilities across the global investment platform. He also heads the London office and sits on the Portfolio Management Group Committee and Evergreen Portfolio Committee. Richard serves as a member of the Investment Committee and represents Hamilton Lane on several fund advisory boards. Prior to joining Hamilton Lane in 2011, Richard worked as a Director with Alliance Trust Equity Partners, where he helped establish a private equity fund investment business together with making a number of direct investments. Previously, Richard worked in the U.K. at Noble Group, where he was responsible for making and managing venture and growth capital investments. Richard received his B.Com. from University of Edinburgh.

Biography

Amy Jupe is a managing director in the External Investing Group (XIG) within Goldman Sachs Asset Management. She is global co-head of the XIG Private Equity Primaries team and global head of the XIG Private Credit team, responsible for manager selection and portfolio construction for private equity manager and private credit manager investments. Amy is co-chair of the XIG Private Equity Primaries Investment Committee and chair of the XIG Private Credit Investment Committee. She also serves as a member of the XIG Imprint Investment Committee and the XIG Real Estate Primaries Investment Committee. Previously, Amy led investments in public markets alternative strategies within the Alternative Investments & Manager Selection Group. She joined Goldman Sachs in 2004 as an analyst in the Global Investment Strategies Group, focusing on asset allocation and other strategic investment issues for institutional clients, and was named managing director in 2019. Amy earned a BA in Economics, with honors, from Durham University in 2004. She is a CFA charterholder.

Biography

Barry Miller is a Partner in the Ares Secondaries Group, where he focuses on private equity secondaries. He is also the Chief Executive Officer of the Ares Private Markets Fund. Additionally, Mr. Miller serves as a member of the Ares Secondaries Group’s Private Equity and Infrastructure Investment Committees and the Ares Diversity, Equity, and Inclusion Council. Prior to joining Ares in 2021, he was a Partner in the Landmark Partners Private Equity Group, where he focused on transaction origination, underwriting and negotiation of private equity investments. Previously, Mr. Miller was Head of Private Equity at the New York City Retirement Systems (“NYCRS”), where he served on the LP Advisory Boards of more than 40 private equity funds. In addition, he was a Partner at Pomona Capital (“Pomona”), where he focused on sourcing and executing secondary transactions and was a member of the Pomona Capital Investment Committee. Prior to joining Pomona, he was a Senior Investment Manager at AXA Private Equity, where he was also Head of the New York office and served on the Global Investment Committee of AXA Private Equity.

Biography

Adrien Perret is a graduate from Ecole Polytechnique and French national school of statistics (ENSAE). He also holds a master degree in economics from Paris School of Economics. He began his career in 2008 at the French national institute of statistics and economic studies (Insee). He joined the French Treasury in 2011, where he held several positions (financial sector analysis, public finances, macro forecasting, public policy analysis). Before integrating the FRR management board in July 2023, he was deputy director for social policies at the French Treasury.

Biography

Angela Roshier joined CVC DIF in 2010 and oversees the value creation of all investments. Previously she was a member of 3i Plc and Actis’s Infrastructure teams, she offers more than 20 years’ experience in the field. Angela has contributed to the origination and asset management of a wide variety of infrastructure assets in the PPP, water, renewable energy and transport sectors in both Europe and emerging markets. Angela holds an MBA from London Business School and an MA from the University of Cambridge.

Biography

Harrie Van Rijbroek is a Senior Director in PGGM’s Private Equity team and serves as a member of the PGGM Private Equity Investment Committee. He is responsible for the investments in the European mid-market segment. Before joining the team in 2016, he worked for over 15 years at the Dutch mid-market private equity firm Bencis, lastly as a Director. From 1996 to 1999, he worked as a Controller Alliance Partners and Manager Corporate Finance at KLM, the Dutch airline company. Harrie holds a master’s degree in finance from Tilburg University, a master’s degree in international finance from the University of Amsterdam and an International Directors’ Program certificate from INSEAD.

New Promises for Private Markets

Program Overview

Tuesday, Jan. 28, 2025

SOCIAL EVENTS

🟠 IPEM Croisette Express (direct train from Paris to Cannes)

Start networking early with 2 eco-conscious workshops on how Private Markets can lead the way in creating a greener future.

🔸Sustainability Pitch Party for GPs actively fundraising (for GPs only)

🔸3 tips to spot forward-thinking GPs (for LPs only)

🟠 Grand Opening Party

Kick off the event in style! Open to all

Wednesday, Jan. 29, 2025

PRIVATE MARKETS TRACK

🟦 Conferences

🟦 Summits

🟦 Breakouts

IPEM WEALTH

🔵 Wealth Track workshops & sessions

🔵 Breakouts

🔵 IPEM Wealth Awards

SOCIAL EVENTS

🟠 Morning Run

🟠 IPEM Wealth Awards Celebration, Part 1

Celebrate the IPEM Wealth Award winners, open bar and open to all!

By invitation only

🟢 LP Breakfast

🟢 LP VC Lunch

🟢 Official Dinner

Thursday, Jan. 30, 2025

PRIVATE MARKETS TRACK

🟦 Conferences

🟦 Summits

🟦 Breakouts

IPEM WEALTH

🔵 Wealth Track workshops & sessions

🔵 Breakouts

🔵 IPEM Wealth Awards

SOCIAL EVENTS

🟠 Morning Run

🟠 IPEM Wealth Awards Celebration, Part 2

Celebrate the IPEM Wealth Award winners, open bar and open to all!

By invitation only

🟢 Women Dealmaker Lunch

🟢 Single Family Office Lunch

🟢 Sustainability Lunch

For everyone involved in private capital

IPEM Cannes’ mission is to connect the complete EMEA private capital industry to raise and distribute funds, source and close deals, and stay up to date of the latest market developments!

Attending participants

- Fund Managers

- Asset Managers

- Institutional Investors

- Single Family Offices

- Wealth / Investment Advisors

- M&A / Investment Banks

- Placement Agents

- Advisors

- Business Services

- Solutions Providers

LP Snapshot

GP Snapshot

Stay tuned, more coming soon…

Learn more about IPEM Wealth

sponsored by Ardian, Carmignac, Eurazeo, Franklin Templeton, Natixis IM, Neuberger Berman, Pictet, Private Corner, Stepstone and Tikehau Capital.

Join us for two days of workshops and networking, connecting over 250 Single Family Offices, Private Banks, Multi-Family Offices, and Wealth Managers with 500 Funds Managers.

Don’t miss the opportunity to gain insights and connect to the fast-growing wealth ecosystem.

All dealmakers converge in Cannes every January

- Kick off your yearly deals

- Accelerate your deal flow

- Facilitate connections with EMEA small and mid-market funds

- Learn more to source, finance, and structure your business

IPEM Cannes | Wealth 2025 Floorplan

IPEM is the EMEA Private Market Ecosystem Gathering, using a unique Floorplan that sets us apart from the rest of the conference industry.

Held at the world-famous Palais des Festivals, against a backdrop offering panoramic views of the iconic French Riviera, it is the ideal setting for the 3,500 private market practitioners attending the event, to inspire, debate, and effect positive change in the industry.

IPEM Croisette Express

At IPEM, we’re committed to a more eco-conscious future, and the Croisette Express is our first step. Book your seat (available soon) to network, connect, and reduce your carbon footprint on this dedicated train journey from Paris to Cannes. It’s more than a trip; it’s a chance to make a difference in the private markets industry.

ARRIVAL >> 5:45 PM in Cannes (4 place de la Gare, 06400 Cannes).

Your IPEM Account

Key features

Elevate your event experience with your IPEM Account. Boost engagement and make meaningful connections in Private Markets.

☑️ Maximize Your Networking Potential:

Tap into advanced tools for seamless connections. Use our innovative algorithm for perfect matches within the industry.

☑️ Unrivaled Event Preparation:

Plan meetings, access the participants’ list, and customize your agenda effortlessly.

☑️ Stay Informed, Stay Ahead:

Real-time updates, offline event program, and all info in one place.

☑️ Experience the Power of Collaboration:

Engage with the private equity community.

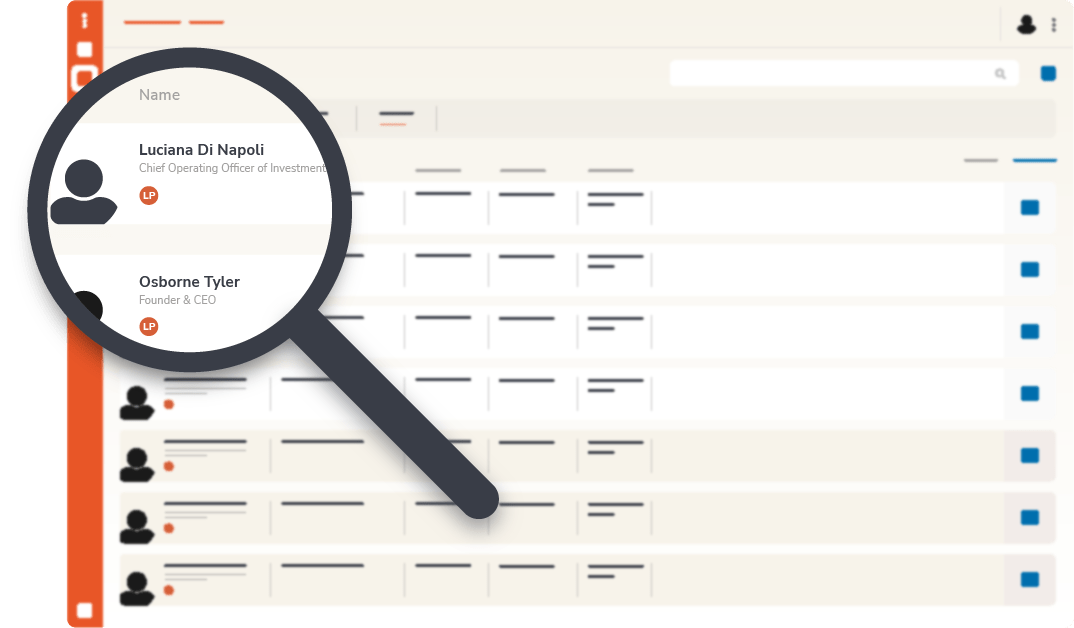

Ipem Account: the must-have

☑️ High-quality connections using our affinity algorithm.

☑️ Filter opportunities to minimize irrelevant solicitations.

☑️ Manage communications with our secure email system.

☑️ Access exclusive reports, replays, photos…

☑️ Maximize your event experience.