IPEM Global 2025 – The Daily Spin – September, 26th

Discover a summary of the sessions at IPEM Global 2025 on Friday 26th, and access the Photo Gallery.

At IPEM Global 2025 (Palais des Congrès, Sept. 24-26), under the theme “Winning the Long Game”, industry leaders will convene to explore how private markets leaders stay disciplines and keep their eye on the ultimate prize all while seizing any hiccups and disruptions along the way as opportunities.

Global Co-CIO

-

BLACKSTONE

.................................................

CEO

-

AMUNDI

.................................................

CIO

-

PGGM

.................................................

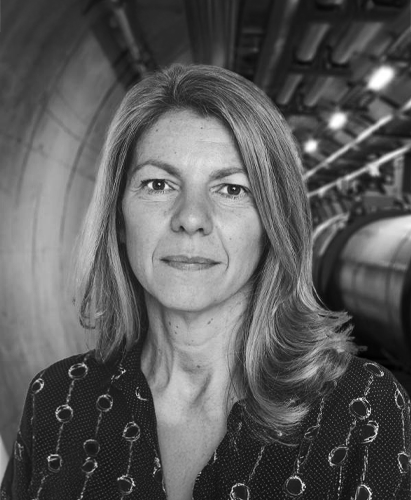

CIO, Board Member

-

CERN PENSION FUND, CAIA

.................................................

CEO

-

MUZINICH & CO.

.................................................

CEO, Chairman & Co-Founder

-

MARATHON ASSET MANAGEMENT

.................................................

An overview of the day ahead and objectives for the program.

| Speaker(s): |

| - Antoine COLSON - CEO | IPEM |

Based on a large scale empirical study, we document the link between Economic Policy Uncertainty and PE returns. This allows us to show that we have to expect further delays in exit activity and downward pressure on returns for deals currently in the portfolio. Contrary to what one would expect, current high levels of EPU might not necessarily lead to lower returns and higher duration for deals done “today”, but instead may create opportunities for deals with high returns and shorter duration. Returns will depend (to an even greater) extent on the skill of the GP, as there seems to be a stable skill that some GPs possess (and others do not) to handle Policy Uncertainty well / take advantage of opportunities created by Policy Uncertainty.

| Speaker(s): |

| - Oliver GOTTSCHALG - CEO | GOTTSCHALG ANALYTICS |

Over 4 billion people went to the polls last year. Private markets investors were told it was a year of “wait and see”, as deals, fundraising and IPOs were put on ice. Fast forward to 2025 and the US election result has had a similar effect on markets. With so much about America’s new role in the world still unclear, should we accept the world is entering a permanent “wait and see” mode?

| Speaker(s): |

| - Ju Hui LEE - Chief, Investment Risk and Performance | UNITED NATIONS JOINT STAFF PENSION FUND |

| - Elena MANOLA BONTHOND - CIO | CERN PENSION FUND |

| Moderator(s): |

| - John BOWMAN - CEO | CAIA ASSOCIATION |

At no time in history have private equity distributions been this low, for this long. Whilst continuation vehicles, NAV finance and evergreen funds are all playing their part to pick up some of the slack, are these more permanent fixtures in a new distribution model?

| Speaker(s): |

| - Ulrich GRABENWARTER - Deputy Chief Investment Officer and Head of Equity Investments | EIF - EUROPEAN INVESTMENT FUND |

| - Lisa LARSSON - Partner and Head of Portfolio Management | STEPSTONE GROUP |

| Moderator(s): |

| - Michael ELIO - Partner | STEPSTONE GROUP |

It’s three years since rising interest rates marked a new chapter for private markets. This research will examine the returns profile across private asset classes and strategies - and consider the outlook.

| Speaker(s): |

| - Gregory BROWN - Professor & Research Director | INSTITUTE FOR PRIVATE CAPITAL |

Institutional investors seem to have reached some limits in terms of allocation to private equity. Regulated entities have threshold to comply with. Denominator effects have to be handled more proactively when allocations are teetering with limits.

| Speaker(s): |

| - Alexandre ARMBRUSTER - Head of Private Equity & Infrastructure funds | CAISSE DES DÉPÔTS ET CONSIGNATIONS |

| - Michael BUTLER - Private Markets Investment Solutions Leader | MERCER |

| - Ludovic SUBRAN - Chief Investment Officer and Chief Economist | ALLIANZ SE |

| Moderator(s): |

| - Ana Maria HARRISON - Partner | ADAMS STREET PARTNERS |

Whilst fund terms are crucial to get right, their standards continue to evolve.

| Speaker(s): |

| - Diego ALAIMO - Head of Multi-Asset - Indirect Private Strategies | GENERALI ASSET MANAGEMENT |

| - Rémi BERTELOOT - Managing Director - Head of Small Cap Funds Investments | BPIFRANCE |

| - - | |

| Moderator(s): |

| - Brian DIGNEY - Research and Content Director | STANDARDS BOARD FOR ALTERNATIVE INVESTMENTS |

The GP universe is larger than it has ever been, and is continually expanding. In tandem, competition to get into sought-after funds is fierce, as capital constrained LPs look to prioritise the few commitments they can make. This session will explore best practices, including some of the new technologies that can support decision-making.

Sessions

| Speaker(s): |

| - Liliya KAMALOVA - Senior Principal | MORGAN STANLEY PRIVATE EQUITY SOLUTIONS |

| - Sofie KULP-TAG - Senior Investment Manager - Private Equity | SKANDIA LIFE INSURANCE COMPANY |

| Moderator(s): |

| - John HOLLOWAY - Senior Advisor | CALISTA DIRECT INVESTORS S.A.S. |

As distributions faltered, innovation in the secondaries market has been a saving grace for DPI. The market looks set to grow, driven by paralysed exit markets and growth of continuation vehicles. These sessions consider how LPs should think about the various parts of their liquidity tookit.

Sessions

| Speaker(s): |

| - Sheila LYNCH - Partner | CORK GULLY |

| - James O’DONNELL - Partner | GIBSON DUNN |

| - Yann ROBARD - Managing Partner | DAWSON |

| Moderator(s): |

| - Bart VAN DIJK - Managing Director, Head of Europe | ILPA |

Enhancing alignment of interests between GPs and LPs remains a hotly debated topic, with concerns over erosion of fiduciary duty and increasing conflicts of interest frequently cited. These sessions go deeper into how LPs can successfully navigate these discussions to ensure positive manager relationships.

Sessions

| Speaker(s): |

| - Eelco FIOLE - Managing Partner | ALPHA GOVERNANCE PARTNERS |

| - Alistair MACKENZIE - Investment Professional | GOODBODY CAPITAL PARTNERS |

| Moderator(s): |

| - Laura MERLINI - Managing Director, EMEA | CAIA ASSOCIATION |

Traditional LPACs offer limited opportunities to consult with other investors in the same fund. In the absence of an official forum, how can LPs build consensus on key issues?

A panel of LPs consider how they could use their bargaining power both individually and as a group.

| Speaker(s): |

| - Anne-Camille DE FROISSARD - Senior Investment Director | PEUGEOT INVEST |

| - Mikkel WINCKLER - CIO | ADVANTAGE INVESTMENT PARTNERS |

| Moderator(s): |

| - Matthew CRAIG-GREENE - Director | WAGTAILS PRIVATE MARKETS |

The rise of private wealth as a source of capital could be teeing up a new wave of conflicts between LPs and GPs. What are the considerations when retail capital is invested alongside institutional capital within the same fund?

| Speaker(s): |

| - Sarah FARRELL - Managing Principal, Head of Private Equity Europe and Asia | ALLSTATE INVESTMENT MANAGEMENT |

| - Joel SANDHU - Partner | INVESTORS CAPITAL |

| Moderator(s): |

| - Jennifer CHOI - CEO | ILPA |

Co-investments - Building Strategic Partnerships

Addressing how institutions identify and evaluate co-investment opportunities through manager relationships. Topics include access mechanisms, underwriting requirements, speed of execution, and risk management. Shared experiences and lessons learned will illustrate the evolving role of trust, alignment, and internal capability building. (15mins presentation + 30mins discussion in roundtable format + 15mins feedback - facilitated by the moderator)

| Speaker(s): |

| - Stephen KIM - Principal | TEACHER RETIREMENT SYSTEM OF TEXAS |

| Moderator(s): |

| - John HOLLOWAY - Senior Advisor | CALISTA DIRECT INVESTORS S.A.S. |

14:00 - 14:30

"Our Journey"

Wadih Manneh

A case study showing challenges and success stories that others can learn from.

14:30 - 15:00

Friend or foe - how to evaluate NAV financing of private capital funds

Matt Hansford

Although not new, NAV financing is gaining traction in a market for slow distributions. What factors should LPs be considering when a GP plans to use this type of financing? How does it change the risk profile of the portfolio? When is the strategy an attractive private debt investment?

| Speaker(s): |

| - MATT HANSFORD - Head of Europe, Portfolio Finance | BARINGS |

| - Wadih MANNEH - Head of Private Markets | ARAB BANK (SWITZERLAND) LTD |

| Moderator(s): |

| - Bart VAN DIJK - Managing Director, Head of Europe | ILPA |

Case study

A theoretical scenario is put to the room by the facilitator, with discussions between participants on what approach they’d take. 15mins presentation + 30mins discussion + 15mins feedback.

| Speaker(s): |

| - Evalinde EELENS - Board Member | STICHTING PENSIOENFONDS VOOR DE ARCHITECTENBUREAUS |

| - Ju Hui LEE - Chief, Investment Risk and Performance | UNITED NATIONS JOINT STAFF PENSION FUND |

| Moderator(s): |

| - Laura MERLINI - Managing Director, EMEA | CAIA ASSOCIATION |

Private markets' assets under management have grown at a CAGR of ca. 15% since 2000. The result is an expansion of investment strategies that provide deeper pools of equity and debt capital which may have traditionally come from public markets. In tandem, the industry has embarked on a journey towards more liquid structures, blurring the lines between the traditional 60/40 approach to asset allocation.

| Speaker(s): |

| - Dora GAMAOUN - Investment Manager and Head of Private Debt | OPTIMUM ASSET MANAGEMENT |

| - Raluca JOCHMANN - Managing Director, Head of Private Markets Solutions | ALLIANZ GLOBAL INVESTORS |

| - Scott PITTMAN - Senior Vice President/Chief Investment Officer | MOUNT SINAI HOSPITAL |

| Moderator(s): |

| - Roger VINCENT - Founder and CIO | SUMMATION CAPITAL |

GPs are managing materially larger portfolios and holding assets longer than ever before. With exit markets constrained, GPs are pursuing a broad range of alternatives to exit assets, generate liquidity and raise mid-fund life capital for their trophy portfolio companies. We will explore the factors driving this extraordinary market growth, how to access this asset class and comparing the growing range of GP-led secondary deal structures and opportunities.

| Speaker(s): |

| - David WACHTER - Founding partner and CEO | W CAPITAL PARTNERS |

In this session, we will unveil the first-ever global league table of private fund managers ranked by alpha performance. Leveraging a robust methodology and data-driven research, this analysis offers a transparent and standardised comparison of fund and manager performance, shedding light on true value creation in private markets.

Key highlights:

| Speaker(s): |

| - Abhishek GUPTA - Head of Business and Product | SCIENTIFIC INFRA & PRIVATE ASSETS |

Presentation

| Speaker(s): |

| - Richard HORVATH - Managing Director of Private Capital Strategies | CLEVELAND CLINIC INVESTMENT OFFICE |

| - Jeffrey MINDLIN - VP of Investments & Chief Investment Officer | ARIZONA STATE UNIVERSITY ENTERPRISE PARTNERS |

| Moderator(s): |

| - Betty SALANIC - Chief Executive Officer | ACCELERATE INVESTORS |

Presentation by Kledge Capital

| Speaker(s): |

| - Michael JOHNSON - Partner | KEDGE CAPITAL PRIVATE EQUITY |

With the growth of GP-led secondaries, which formed 12% of all PE exits in 2024 and 15% in the first half of 2025, LPs face an unprecedented number of sell/roll decisions. Given other priorities and the complexity of due diligence, investors face potentially missing out on attractive deals or retaining exposure to assets that have limited further upside. In this session we will explore strategic approaches to triaging these opportunities to unlock value and add alpha to LP’s portfolios.

| Speaker(s): |

| - Valerie HANDAL - Managing Director | HARBOURVEST PARTNERS |

Private debt is a clear growth engine in private markets, with no sign of slowing up. Yet this rapid expansion requires more sophisticated asset allocation frameworks, as LPs seek to understand the diversification and risk/return opportunities. What’s the right approach?

| Speaker(s): |

| - Amit BAHRI - Partner in Private Credit and co-head of the European Direct Lending business | GOLDMAN SACHS ALTERNATIVES |

| - Nachiketa RAO - Managing Director External Investing Group (XIG) | GOLDMAN SACHS ALTERNATIVES |

Presentation

Climate risks remain underpriced across real asset markets. Integrating both physical and transition risks into expected and required return models is essential to reflect the true impact of climate change. By comparing valuations with and without climate integration, investors uncover which sectors—across infrastructure, natural capital, and real estate—offer the most resilient and attractive opportunities.

| Speaker(s): |

| - Ralf KOOKEN - Portfolio Manager Infrastructure | A.S.R. REAL ASSETS INVESTMENT PARTNERS |

Private assets offer diversification benefits and potential for enhanced returns in multi-asset portfolios. However, integrating them into liquid portfolios presents practical challenges, including performance measurement, liquidity management, and capital planning. This session provides a practical framework for sizing private assets within a global allocation and designing tailored pacing strategies to help institutional investors incorporate private assets effectively and achieve long-term objectives.

| Speaker(s): |

| - Gabriele BALAGNA - Principal | AMUNDI ALPHA ASSOCIATES |

| - Nicola ZANETTI - Quantitative Analyst, Multi Asset Quant Solutions | AMUNDI |

Key takeaways of the day

| Speaker(s): |

| - Philipp PATSCHKOWSKI - Managing Director | NEUBERGER BERMAN |

| - Francis QUINT - Global Head of Rabo Investments and NVP board member | RABOBANK GROUP |

| - Viviane TING - Partner, Head of CIO Office | AMUNDI ALTERNATIVE AND REAL ASSETS |

| - Bart VAN DIJK - Managing Director, Head of Europe | ILPA |

| Moderator(s): |

| - Edouard DURAND - Head of IR and international affairs | FRANCE INVEST |

Key takeaways from the day.

Join us for the official Opening Reception of IPEM Paris 2025, at one of Paris' most iconic venues, the Parc des Princes!

Venue: Parc des Princes

Door L, 23 rue du Commandant Guilbaud, 75016 Paris

How do I get there from the Palais des Congrès?

There will be a free shuttles service to Parc des Princes (limited seats), from 6 PM to 8 PM. The shuttle service meeting point will be at the entrance of Hyatt Regency Paris Étoile. To access both the shuttles and the Opening Reception, you will need to present your color-printed pass!

Welcome Remarks by IPEM CEO, Antoine Colson

| Speaker(s): |

| - Antoine COLSON - CEO | IPEM |

Chair’s Welcome Remarks

| Speaker(s): |

| - Cord STUEMKE - Europe West Private Equity Industry Leader | EY |

This keynote will delve into the investment opportunities in the digital economy, the demand for power and the AI revolution, highlighting the pivotal role that private capital can play in driving innovation, economic transformation and growth.

| Speaker(s): |

| - Lionel ASSANT - Global Co-Chief Investment Officer | BLACKSTONE |

| Moderator(s): |

| - Arash MASSOUDI - Finance and Markets Editor | FINANCIAL TIMES |

In the next decade, as private markets continue to mature, public and private markets will converge. The effects will be profound on wealth creation, the size of the investable universe and how companies raise capital. We sit down with a leading figure in asset management to make sense of the consequences - discussing the outlook for traditional and alternative assets, the trajectory for retailisation and what it means for the asset management industry going forward.

| Speaker(s): |

| - Valerie BAUDSON - Chief Executive Officer of Amundi, Member of Executive Committee of Crédit Agricole | AMUNDI ALTERNATIVE AND REAL ASSETS |

| Moderator(s): |

| - Julianna TATELBAUM - TV News Anchor & Private Markets correspondent for CNBC Europe | CNBC |

Against the backdrop of Europe's complex operating landscape, there are encouraging long-term growth prospects for private capital. But what vision of the future are we striving for? In this conversation, we travel to the horizon to envisage how the economy looks if the transformational potential of private capital is fully realized; and look back on the last pivotal decade to understand what changed, what didn’t, and the policies and shifts that set the stage for the industry’s future.

| Speaker(s): |

| - Philipp FREISE - Partner, Co-Head of European Private Equity | KKR |

| Moderator(s): |

| - Kriti GUPTA - Anchor | BLOOMBERG NEWS PARIS |

Macro uncertainty is shining a new light on Europe as an attractive destination to raise and deploy capital. However, investment hold periods outlast election cycles - and macro conditions can change quickly. To help investors make sense of the enduring effects on both the appeal of the US and Europe, this session explores what scenarios investors need to consider.

| Speaker(s): |

| - Christophe BAVIÈRE - Co-Chief Executive Officer | EURAZEO |

| - Justin MUZINICH - Chief Executive Officer | MUZINICH & CO |

| Moderator(s): |

| - Swetha GOPINATH - Private Equity Reporter | BLOOMBERG NEWS - LONDRES |

Reindustrialisation and resilience have been eternal topics for the European economy. But war in Ukraine and US policy shifts are a catalyst that cannot be ignored. As governments ramp up the rhetoric around defence, energy and digitalisation, what is the opportunity for private capital investors?

| Speaker(s): |

| - Nicolas DUFOURCQ - CEO | BPIFRANCE |

| - Dominic RAAB - Head of Global Affairs | APPIAN CAPITAL ADVISORY |

| Moderator(s): |

| - Darius CRATON - Director, Private Capital Advisory | RAYMOND JAMES |

How are LPs approaching new investments and what do they need to see from GPs when deciding where to allocate-regions, sectors, fund strategies?

The IPEM 2026 Allocation and Fundraising Report, created in collaboration with AlixPartners, examines the investment preferences of over 1,000 limited partners (LPs) and the fundraising efforts of more than 800 general partners (GPs) at the conference. The report provides insights into the current market landscape, outlines where LPs intend to invest, details their priorities and selection criteria, and highlights key market opportunities and imbalances

| Speaker(s): |

| - Nicolas BEAUGRAND - Partner & Managing Director | ALIXPARTNERS |

| Moderator(s): |

| - Antoine COLSON - CEO | IPEM |

The first venture capital deal was done after the second world war. The first LBO in the 1960s. As private markets grow, they gain in efficiency. Information flows more readily, is richer, produced more often, which reduces market imperfections and risks. Sourcing of deals is more competitive, as there is not only more capital but also more actors. Valuations tend to increase. As a consequence, returns are expected to decrease over the mid-term. Is this a worry for fund managers and fund investors? If not, how do they analyse the impact of the fast growth and increasing maturity of private markets? If yes, how do fund managers plan to address this trend?

| Speaker(s): |

| - Thibault BASQUIN - Member of the Executive Committee, Executive Board Member of Ardian US LLC, Co-Head & CIO of Buyout | ARDIAN |

| - Benoît DURTESTE - CEO & CIO | ICG |

| Moderator(s): |

| - Carmela MENDOZA - Senior Reporter | PEI GROUP |

Private equity is at an inflection point. The new realities facing investors today may require another look at regional opportunities between the US and Europe. From internationalisation towards regional blocks, restrictions on trade flows and commerce, as well as recurring constraints on M&A might require some further adaptation. How may buyout platforms navigate these significant changes?

| Speaker(s): |

| - Roberto QUAGLIUOLO - Deputy Head of Private Equity | TIKEHAU CAPITAL |

| - Robert SEMINARA - Senior Partner, Head of Europe & Head of European PE | APOLLO |

| - Brian W. BERNASEK - Co-Head of Americas Private Equity | CARLYLE GROUP |

| Moderator(s): |

| - Lucinda GUTHRIE - Executive Editor | Mergermarket, a service of ION Analytics | ION ANALYTICS |

As Trump’s tax bill passed through Congress, investors began to vote with their feet. Tariffs and concerns over the debt ceiling prompted the start of a rotation away from US assets. How should private markets investors navigate this new period of risk? What premium are they placing on risk assets? What’s the net impact of tariffs on portfolios? How do firms ensure agility in risk management practices during such a period?

| Speaker(s): |

| - Matthias BOYER-CHAMMARD - Partner, Europe PE | BAIN CAPITAL |

| - David MIHALICK - Co-Head of Global Investments | BARINGS |

| - Virginie MORGON - Founding Partner | ARDABELLE CAPITAL |

| Moderator(s): |

| - Alexandra HEAL - Private Capital Reporter | FINANCIAL TIMES |

Private markets have a knack for reinventing themselves. As they gather an ever-increasingly large amount of assets under management, there is a risk of banalisation. How is the industry addressing it? What are the main trends underpinning future growth? How is this industry changing?

| Speaker(s): |

| - Laurent MIGNON - Group CEO | WENDEL GROUP |

| - Andrew OLINICK - Head of Private Equity | MACQUARIE ASSET MANAGEMENT |

| - Sophie PATURLE - President | FRANCE INVEST |

| Moderator(s): |

| - Sophie JAVARY - Vice Chairman CIB EMEA | BNP PARIBAS |

Private debt continues its steady progress to win market share from traditional sources of finance – from asset-backed debt to investment grade credit. Why and how are funds stealing a march? How do debt funds measure up against capital markets syndication on depth, speed and terms? What do the various private debt strategies offer investors?

| Speaker(s): |

| - Gene MIAO - Senior Managing Director, Senior Investment Strategist and Co-Head of Consultant Relations | CHURCHILL ASSET MANAGEMENT |

| - Rory O’NEILL - Managing Partner, Executive Chair | CASTLELAKE |

| - Bruce RICHARDS - Chief Executive Officer, Chairman and Co-Founder | MARATHON ASSET MANAGEMENT |

| Moderator(s): |

| - Sayed KADIRI - European managing editor | 9FIN |

2025 was billed as the year that the exit market finally picked up. More stable interest rate outlook and rising equity markets looked set to boost both secondary buyout and IPO activity. Then geopolitics took over, spiking volatilty and shuttering deal markets. Where do we stand now? How are firms adapting their exit horizons? Does a more volatile market risk the ability of PE to complete exits?

| Speaker(s): |

| - Carolina ESPINAL - Managing Director | HARBOURVEST PARTNERS |

| - Christian LUCAS - Managing Partner | SILVER LAKE |

| - Raymond SVIDER - Partner & Chairman - Executive Committee | BC PARTNERS |

| Moderator(s): |

| - Anne HIEBLER - Global Head of M&A | CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK |

If you had the chance to throw out the rulebook and design a new private markets firm that’s built for a new era of investing, what would it look like?

| Speaker(s): |

| - Marcus BRENNECKE - Institutional Partner and Chairman EQT Foundation | EQT |

| - Jeffrey FINE - Global co-head of Alternatives Capital Formation | GOLDMAN SACHS ALTERNATIVES |

| - Sheel TYLE - co-founder and co-CEO | COLLECTIVE GLOBAL |

| Moderator(s): |

| - Emmanuelle DUTEN - Events Manager | LES ECHOS CAPITAL FINANCE |

Concluding remarks to summarise key takeaways.

| Speaker(s): |

| - Cord STUEMKE - Europe West Private Equity Industry Leader | EY |

An overview of market trends.

| Speaker(s): |

| - Emmie JONES - Partner | WHITE & CASE |

| Speaker(s): |

| - Birgit BRUECK - Senior Fund Manager | KFW CAPITAL |

| - Sion EVANS - Investment Director | VENCAP |

| - Thomas SCHNEIDER - Partner | ISOMER CAPITAL |

| - Jeroen VAN DOORNIK - Founder and Managing Partner | PACENOTES |

| Moderator(s): |

| - Dorothee STIK - Managing Director - Head of Innovation Economy for France, Benelux & Southern Europe | J.P. MORGAN |

| Speaker(s): |

| - Salomé CAILLAT - Growth Investor | REVAIA |

| - Frederic HUYNEN - Partner | HPE GROWTH |

| - Karen MCCORMICK - CIO | BERINGEA |

| Moderator(s): |

| - Guillaume VITRICH - Partner | WHITE & CASE |

When the market fails to present the right opportunity, why not create the market yourself? This conversation will dig deeper into an innovative approach that uses blind pool funds to launch, build and scale investable companies from scratch. We ask about the ingredients, the recipe and whether the final dish is worth a taste.

| Speaker(s): |

| - Marc BHARGAVA - Managing Director | GENERAL CATALYST |

| - Patrick CHUN - Founding and Managing Partner | JUXTAPOSE VENTURES |

| - Ketevan LIPARTELIANI - Senior Investment Officer | INTERNATIONAL FINANCE CORPORATION (IFC) |

| Moderator(s): |

| - Joe BRIGGS - Managing Partner & Founder | BCF |

Transformation, consolidation and disintermediation - three big themes that continue to drive investment activity in the financial services space. Our speakers take a whistle-stop tour around the key sub-sectors that will generate dealflow in the coming year; insurance, wealth management, regtech and more.

| Speaker(s): |

| - Hugo BONGERS - Partner at Motive Ventures | MOTIVE PARTNERS |

| - Curt GUNSENHEIMER - Managing Partner | IRIS |

| Moderator(s): |

| - Emmie JONES - Partner | WHITE & CASE |

If the future of venture is in partnerships, then corporate VCs may have a headstart. This session explores how they operate, what they gain from being part of industrial groups and what’s in it for third-party investors.

| Speaker(s): |

| - Nicolas MILERIOUX - Head of Venture capital | ENCEVO |

| - Tamara STEFFENS - Managing Director | THOMSON REUTERS VENTURES |

It’s a well-known fact that diverse funds receive a fraction of the available capital in any given year. And yet these businesses are often some of the best performers. What’s wrong with conventional investment sourcing and diligence that’s missing these opportunities - and how would you redesign processes that see the whole market? Speakers will look at the topic from a venture and PE perspective.

| Speaker(s): |

| - Adam CHOPPIN - Asst. Portfolio Manager, Multi-Manager Strategies | XPONANCE |

| - Gulsah WILKE - Partner and Head of Germany | DN CAPITAL |

| Moderator(s): |

| - Pauline ROUX - Partner | ELAIA |

Opening remarks providing context for today’s private infrastructure market.

| Speaker(s): |

| - Mathias BURGHARDT - Executive Vice-President, CEO of Ardian France and Head of Infrastructure | ARDIAN |

| - Nikolova PETYA - DCIO | NEW YORK CITY RETIREMENT SYSTEM |

| Moderator(s): |

| - Talya MISIRI - Senior Reporter | Infralogic, a service of ION Analytics | ION ANALYTICS |

Infrastructure investing has come a long way since the privatisations of the late 1980s and the secondary trades of the 1990s and 2000s. But some worry that the classical definition of a captured and reliable revenue stream has been stretched too far. In the new context of today’s more challenging markets, is it a natural progression as the asset class matures; or does the definition require an update?

| Speaker(s): |

| - Wandy HOH - Head of Infrastructure Secondaries | MACQUARIE ASSET MANAGEMENT |

| - Esther PEINER - Partner, Head Private Infrastructure | PARTNERS GROUP |

| - Sikander RASHID - Global Head of AI Infrastructure & Head of Europe | BROOKFIELD |

| Moderator(s): |

| - Julien BAUDINAUD - Partner | ACCURACY |

Infrastructure strategies have stolen the thunder of other private markets assets, continuing to attract LP capital thanks to strong tailwinds. Whilst primary allocations may be slowing as the asset class matures, secondaries are on the rise. LPs have the opportunity to adapt new approaches against the backdrop of a difficult market and capricious political environment.

| Speaker(s): |

| - Marta PEREZ - Head of Infrastructure | ALLIANZ GLOBAL INVESTORS |

| - Maria SURINA - Managing Director, Real Assets | CAMBRIDGE ASSOCIATES |

| - Dominik VONSCHEVEN - Managing Director, Infrastructure Investments | HAMILTON LANE |

| Moderator(s): |

| - Lukas ZEMAN - Managing Director | CAMPBELL LUTYENS |

Opening remarks that set the scene on how to understand climate risk in the infrastructure market of the future.

| Speaker(s): |

| - Rémy ESTRAN - Chief Executive Officer | SCIENTIFIC CLIMATE RATINGS |

Infrastructure includes some of the most significant sectors for transition and resilience goals, including energy, digital, public infrastructure and real estate. Therefore, what contribution towards meeting these goals can infrastructure make? From renewables to climate resilient assets, this panel will evaluate the role infrastructure investment will play in enabling a credible and material transition.

| Speaker(s): |

| - Corinne BACH - Co-CEO | CARBOMETRIX |

| - Stéphanie BÉGUÉ - Managing Partner | RGREEN INVEST |

| - Fabrice FRAIKIN - Managing Partner, Founder | FLEXAM / KARTESIA ASSET FINANCE (PARIS) |

| - Jean-François MARCO - Partner | TIIC |

| Moderator(s): |

| - Charles DE LA FERRIÈRE - Head of Infrastructure France | AON M&A AND TRANSACTION SOLUTIONS |

While the decisions of the Trump administration and European energy producers like BP and Shell may have stolen a few headlines, investment in energy transition assets is not only continuing but accelerating. Consultancy KPMG reported that 72% of the 1,400 international energy transition investors it interviewed shared this view with 52% investing in Europe. But would-be investors in the sector must also navigate a difficult mix of regulatory and policy risks if they are serious about being part of the transformation.

Energy transition experts deconstruct the myths and set out the realities of investing in the energy transition and discuss why it is a movement they cannot afford not to be a part of.

| Speaker(s): |

| - Stéphanie BÉGUÉ - Managing Partner | RGREEN INVEST |

| - Scott GOSSELINK - Managing Director | GENERATE CAPITAL |

| - Alejandro LOPEZ-DELGADO - Managing Director, Infrastructure | LA CAISSE |

| - James MITTELL - Principal | ACTIS |

| - Luis QUIROGA - Co-founder & Head of Investor Relations | ASPER INVESTMENT MANAGEMENT |

| Moderator(s): |

| - Peter KNELLER - Europe Editor, NEW PROJECT MEDIA | NEW PROJECT MEDIA (NPM) |

Lunch

The latest data and trends on investment activity.

| Speaker(s): |

| - Philippe CAMU - chairman and co-chief investment officer of Infrastructure Investing | GOLDMAN SACHS ALTERNATIVES |

In this session, we present a number of hypothetical transactions to the panel and ask them to comment on how they would evaluate each opportunity - including diligence, risks, structuring, as well as sector and ESG considerations. Which opportunities will the panel take forward to their imaginary IC?

| Speaker(s): |

| - Fabrice DUMONTEIL - President | EIFFEL INVESTMENT GROUP |

| - Mathilde KETOFF - Partner | RGREEN INVEST |

| - Marie-Suzanne MAZELIER - CIO | SCOR INVESTMENT PARTNERS |

| - Michele SINDICO - Investment Director | P CAPITAL PARTNERS |

| Moderator(s): |

| - Lucie MIXERAS - Investment Director | IFM INVESTORS |

If anyone still had doubts about the importance of digital infrastructure, they were quickly dispelled over the last twelve months by a slew of multi-billion dollar deals. The UK and the European Commission have also underlined the essential nature of datacentres and assets providing digital connectivity such as fibre optic and mobile networks, cloud and edge computing, internet exchange and network infrastructures.

But the sheer scale of digital infrastructure roll out and energy demand has presented unforeseen problems while some have question whether coverage has already reached saturation point in some markets, calling into question the long-term yield upside of some of these assets:

Digital infrastructure investors and sponsors debate the longer-term future of this maturing part of the asset class.

| Speaker(s): |

| - Manjari GOVADA - Managing Director, Investment Management | DIGITALBRIDGE |

| - Dimitrios PAPATHEODOROU - HEAD OF HIGH YIELD INVESTMENTS - INFRASTRUCTURE DEBT | HSBC ASSET MANAGEMENT |

| - Warren ROLL - Managing Director, Head of Digital Infrastructure | FENGATE ASSET MANAGEMENT |

| Moderator(s): |

| - Talya MISIRI - Senior Reporter | Infralogic, a service of ION Analytics | ION ANALYTICS |

While European governments continue to operate in financially straitened circumstances, the dash for growth has meant investment in transport and logistics should continue to buck the trend. Renationalisation of rail franchises has continued in the UK but a spike in rail investment is expected in Spain and bluer-sky projects such as the Starline High-Speed Network are being discussed. Meanwhile the continent’s airports are still attracting international investor interest. The EU is pressing ahead with its plan to prioritize stable and efficient transport through it Connecting Europe Facility and the UK is hoping to secure private funding for major projects like the £10bn Lower Thames Crossing.

Transport experts, investors, operators and policymakers discuss European government efforts to bring transport infrastructure up-to-date and ask what opportunities this could present infrastructure investors

| Speaker(s): |

| - Gabriele DAMIANI - Head Infrastructure Core/Core+ | SWISS LIFE ASSET MANAGERS |

| - Romain LE MELINAIDRE - Executive Director, Equity | INFRANITY |

| - Amélie PETIT - Managing Director | STONEPEAK |

| Moderator(s): |

| - Laurence MOORE - Senior Banker Infrastructure Investors | CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK |

Early investments in infrastructure have matured at a time when fiscal, geopolitical and technological developments are set to challenge and transform the very nature of the asset class. Investors and their advisors must therefore plan for what may well be an entirely different landscape of essential services which must be fit for new demands.

Senior infrastructure investors and their advisors discuss how they imagine the infrastructure landscape in two decades time and reveal their predictions for the challenges and opportunities of the second half of the 21st century

| Speaker(s): |

| - Sébastien LECAUDEY - Senior Partner | ANTIN INFRASTRUCTURE PARTNERS |

| - Sophia OUMARY - Managing Director – Global Head of Sovereign Wealth Funds & Financial Sponsors Coverage | FIRST ABU DHABI BANK |

| - Boe PAHARI - Chairman | VE1 |

| - Julien TOUATI - CEO | REED SOCIETE GENERALE GROUP |

| Moderator(s): |

| - Petra FREDDI - Managing Director, Europe and & Middle East | MILKEN INSTITUTE |

Against the volatile backdrop of US politics, investors looking at North America are seeking sophisticated hedging opportunities to mitigate risk in an increasingly uncertain environment. Concerns about the wide-sweeping tariffs and intensifying trade wars - and a possible recession as a consequence of the two – are heavy on investors’ minds. This session will explore:

| Speaker(s): |

| - Chip BAIRD - Co-Founder and Managing Partner | GREYLION PARTNERS |

| - Michael HOLLANDER - Managing Director | GTCR |

| - Toni RINNEVAARA - Partner and Chief Investment Officer | AMERICAN INDUSTRIAL PARTNERS |

| - Pedro VAZ - Managing Director | CHARLESBANK CAPITAL PARTNERS |

| Moderator(s): |

| - Roberta BRZEZINSKI - Partner and Head of Americas Business Intelligence | CONTROL RISKS |

Despite the many challenges raising, the US mid-market remains a fertile hunting ground for investors. Aside from traditional industrials, transportation and healthcare, opportunities exist in megatrends like artificial intelligence and climate change. This session will explore:

| Speaker(s): |

| - Alex ABELL - Managing Partner | RCP ADVISORS |

| - Nitin GUPTA - Managing Partner - Co-CIO | FLEXSTONE PARTNERS |

| - Nicholas MCGRANE - Co-Head of North American Private Equity | INVESTCORP |

| Moderator(s): |

| - John BOWMAN - CEO | CAIA ASSOCIATION |

America is in the grips of Maganomics, an economic policy that prioritises wealth and prosperity for all. Whilst commentators take a cautious view over the strategy, investors are trying to establish how to back the winners from such an approach. This discussion will consider how the approach may be changing origination and value creation strategies, as well as what LPs can do to position themselves to mitigate risk and capitalise on US opportunities.

| Speaker(s): |

| - Dana CAREY - Chief Investment Officer – Credit, Chairman of the Investment Committee | MIDOCEAN PARTNERS |

| - Thibaud ROULIN - HEAD OF NORTH AMERICA | PICTET |

| - Sean WARD - Managing Partner | HICKS STREET HOLDINGS |

| Moderator(s): |

| - Roberta BRZEZINSKI - Partner and Head of Americas Business Intelligence | CONTROL RISKS |

Overview of operating partner benchmarks

| Speaker(s): |

| - Kitson SYMES - Partner | SINGULIER |

Portfolio management is entering a new phase. Growth is hard won. Strategic execution is critical. For leading managers, multiple arbitrage was never a long-term value creation plan. This session gathers GPs with a deep reputation for operational excellence about how they view the road ahead.

| Speaker(s): |

| - Marc FOURNIER - Managing Partner | SERENA |

| - Jim CARLISLE - Managing Director, Head of Technology & Business Solutions | THL |

| - Olivier LAROCHE - Partner | INFRAVIA CAPITAL PARTNERS |

| - Bjorn RUWALD - Partner, Head of Operational Support Group | BRIDGEPOINT |

| Moderator(s): |

| - Rémi PESSEGUIER - CEO and Founder | SINGULIER |

Keynote Presentation

The rapid development of AI will make the impossible, possible…and sooner than you think. In this session, we hear about Anthropic’s vision of the future - and how it will redefine companies and growth.

| Speaker(s): |

| - Guillaume PRINCEN - Head of EMEA | ANTHROPIC |

| Moderator(s): |

| - Daphné LEPRINCE-RINGUET - French Tech Reporter | SIFTED |

Case study followed by Roundtables

At the foundation of digital transformation is a coherent data strategy. This session explores how PE firms develop the right capabilities to unlock innovation across their portfolio.

| Speaker(s): |

| - Vincent GROSGEORGE - Director | INFRAVIA CAPITAL PARTNERS |

| - Oussama MOUSTABCHIR - | SINGULIER |

| Moderator(s): |

| - Andrew DAWSON - Managing Partner | SINGULIER |

| - Gaël GIBERT - Senior Director | ADVENT INTERNATIONAL |

| - Clément MARTY - Head of Digital Transformation & Managing Director | ARDIAN |

What use cases are most impressive for AI within portfolio companies? How are firms building their aptitude with the technology? What does it mean for exit planning? How close are we to a one-person unicorn?

| Speaker(s): |

| - François CANDELON - Operating Partner | SEVEN2 |

| - Gaël GIBERT - Senior Director | ADVENT INTERNATIONAL |

| - Ryan O'HOLLERAN - Head of Sales, Enterprise & Startups EMEA | ANTHROPIC |

| Moderator(s): |

| - Sofia KARADIMA - Head of Market Intelligence & Community Engagement | ACTUM GROUP |

Case Study

The question about whether to “buy” or “build” AI expertise is an active discussion within many GPs. After all, the technology is developing at a rapid pace, which means hiring (and retaining) the best talent in order to effectively deploy the technology across the portfolio. What if there was another way?

| Speaker(s): |

| - Mattias HOLMSTROM - Partner | ALTOR EQUITY PARTNERS A/S |

| - Simon WILLIAMS - Partner and Founder | WOVENLIGHT |

Once considered a specialist function, sustainability is now shaping the full arc of private equity value creation — from sourcing and operational playbooks to exit narratives. In today’s polycrisis world, it’s not just about upside: sustainability is increasingly seen as a lever for protecting value amid volatility. Crucially, it’s also how LPs are beginning to assess the future-fitness of GPs — and how they’ll stay relevant in a fast-changing investment landscape.

| Speaker(s): |

| - Joana CASTRO - Partner, Private Equity | UNIGESTION |

| - Elin LJUNG - Operating Partner, Head of Sustainability & Communications | NORDIC CAPITAL |

| Moderator(s): |

| - Imène MAHARZI - Co-Founder | WEASTEM - FINANCE X STRATEGIES FOR THE NEW CLIMATE ERA |

Whilst core IT systems are the backbone of organisations, replacing or upgrading systems can be a tempting way to drive efficiency and scale. However, rolling out ERP systems can be high stakes. How do PE owners best support these major projects? What is best practice? Are the outcomes always as good as predicated?

| Speaker(s): |

| - Marc BOULLIER - Managing Director | PAI PARTNERS |

| - Marco FERRIGO - Chief Digital Officer | FSI |

| - Arnaud HOUETTE - Managing Partner | EXTENS |

| - Clément MARTY - Head of Digital Transformation & Managing Director | ARDIAN |

| Moderator(s): |

| - Nicolas MONNIER - CEO | SAP FRANCE |

Software spend often represents one of the largest expense items for portfolio companies. How do CFOs get a holistic view on software requirements - then procure technology in an efficient and transparent way, at the best possible price?

| Speaker(s): |

| - Michelle KELLER-HOBSON - Director, Private Equity Business Development | VERTICE |

| - Evelina STROMBERG - Private Equity Business Development | VERTICE |

Disruption and digital transformation are changing the landscape for recruiting and retaining workers. Sophisticated private equity owners are now taking a more strategic approach; building talent pipelines and placing greater emphasis on the factors that will differentiate companies in the future - notably leadership and culture. How are those firms doing it?

| Speaker(s): |

| - Thomas D'HAUTEVILLE - CEO | INNERSHIP |

| - Ellen Marie NYHUS - CEO Elevate | VERDANE CAPITAL |

| Moderator(s): |

| - Olivier FRENETTE - Business partner | INNERSHIP |

Over the past five to seven years, LBO has increasingly focused on external growth through buy-and-build. Is this trend expected to continue? In parallel, multiple deals have targeted former VC deals, but also worked as active minority investors in deals in the luxury sector. Is this the future for LBO? Do we see a convergence between growth equity and LBO? If so, what are the consequences? Is LBO going to refocus more on growth-oriented transactions?

| Speaker(s): |

| - Nassim CHERCHALI - Managing Partner | ANACAP |

| - Karsten LANGER - Managing Partner | THE RIVERSIDE COMPANY |

| - Vincent PAUTET - Partner | CHARTERHOUSE CAPITAL PARTNERS |

| Moderator(s): |

| - Sofia KARADIMA - Head of Market Intelligence & Community Engagement | ACTUM GROUP |

Keynote session by Prince Pavlos of Greece

| Speaker(s): |

| - Pavlos of Greece HRH CROWN PRINCE - Investor | MILLENNIAL PARTNERS |

Freak weather events are taking a significant economic toll. Heatwaves, floods and drought shut down supply chains, damage infrastructure and upset the social fabric. The cost of the disruption is estimated at $122bn every year. If the economic risks are now too significant to ignore, what does this mean for “business as usual” private equity? Is the industry still climate-blind?

| Speaker(s): |

| - Jan Erik SAUGESTAD - CEO | STOREBRAND ASSET MANAGEMENT |

European GPs are global leaders in decarbonisation as a lever for value creation. However, less than half of US and Asian GPs report portfolio carbon emissions. What can international GPs learn from their European counterparts? What are some of the effects on investment performance where decarbonisation is non-core? What can LPs do to scrutinise efforts?

| Speaker(s): |

| - Carl ATKIN-HOUSE - Managing Director, Natural Capital Strategy | CLIMATE ASSET MANAGEMENT |

| - Ferdinand DALHUISEN - Managing Director, ODDO BHF Private Equity | ODDO BHF |

| - Erik NOBEL - Managing Director | LEVINE LEICHTMAN CAPITAL PARTNERS |

| - Ellenor TWIGDEN - Head of Impact | HAVN CAPITAL |

| Moderator(s): |

| - Charlotte O'LEARY - CEO | PENSIONS FOR PURPOSE |

Twenty years into the journey, climate investing has become a feature of the private capital landscape; from VCs financing innovative deeptech, to growth and buyout investors that fund proven technologies.

Representatives from across this spectrum are asked to address three questions in 7 min presentations + 2mins Q&A:

| Speaker(s): |

| - Romain DECHELETTE - Partner | INFRAVIA CAPITAL PARTNERS |

| - Sofia RAMIREZ - Principal | AGFUNDER |

| - Fabio RANGHINO - Partner and Head of Strategy & Sustainability | AMBIENTA |

| - Sakari SAARELA - Partner | UNITED BANKERS |

| Moderator(s): |

| - Imène MAHARZI - Co-Founder | WEASTEM - FINANCE X STRATEGIES FOR THE NEW CLIMATE ERA |

The policy spasms emulating from the US are rewiring capital flows on green issues. Yet it creates space for a generation of global investors to step in and play a leading role. How do investors from the Middle East, Africa and Asia define their climate investing ambitions in this new geopolitical climate? In the absence of the US dominating the climate agenda, could this be a redefining moment for the sector, with investment in closer proximity to regional needs?

| Speaker(s): |

| - Anthony CATACHANAS - Founding Partner & Chief Executive Officer | TOWER PEAK PARTNERS |

| - Anne-Laurence ROUCHER - Managing Director | MIROVA |

| - - | |

| Moderator(s): |

| - Nadia KOUASSI - Head of Research | AVCA – AFRICAN PRIVATE CAPITAL ASSOCIATION |

For all organisations, climate has evolved from a peripheral concern to a central consideration. For LPs, the managers and portfolio companies they invest in are no different. But is manager due diligence up to the challenge? Can standard selection processes be enhanced to identify those who are best setup to succeed in a VUCA world? What are the characteristics around incentives, investments and monitoring that indicate a futureproof GP?

| Speaker(s): |

| - Caroline BRUN ELLEFSEN - Head of Sustainability in Funds of Funds | BPIFRANCE |

| - Kelli FONTAINE - Partner | CENDANA CAPITAL |

| - Matteo SQUILLONI - Head of Climate Transition (private equity funds) | EIF - EUROPEAN INVESTMENT FUND |

| - Viviane TING - Partner, Head of CIO Office | AMUNDI ALTERNATIVE AND REAL ASSETS |

| Moderator(s): |

| - Emmanuel PARMENTIER - Founder and Managing Partner | WEASTEM - FINANCE X STRATEGIES FOR THE NEW CLIMATE ERA |

Networking Lunch

This summit is by invitation only. However, all LPs are welcome to attend. To reserve a spot, please contact ashling.barry@ipem-market.com

| Speaker(s): |

| - Kim POCHON - Principal & Global Head of Primary Investments | UNIGESTION |

Fireside Chat

This summit is by invitation only. However, all LPs are welcome to attend. To reserve a spot, please contact ashling.barry@ipem-market.com

| Speaker(s): |

| - Bernard SABRIER - CEO & Chairman - Board | UNIGESTION |

| Moderator(s): |

| - Leon SINCLAIR - Managing Director | PREQIN, A PART OF BLACKROCK |

This summit is by invitation only. However, all LPs are welcome to attend. To reserve a spot, please contact ashling.barry@ipem-market.com

| Speaker(s): |

| - Salik AHMED - Associate, Research Insights | PREQIN, A PART OF BLACKROCK |

3 x 5min pitching slots

This summit is by invitation only. However, all LPs are welcome to attend. To reserve a spot, please contact ashling.barry@ipem-market.com

| Speaker(s): |

| - Brad ROSSI - Managing Partner | ALLIED INDUSTRIAL PARTNERS |

| - Adarsh SARMA - Partner | A3/C PARTNERS |

| - Sander VAN WOERDEN - Founding Partner | LEXAR PARTNERS |

Panel Session

This summit is by invitation only. However, all LPs are welcome to attend. To reserve a spot, please contact ashling.barry@ipem-market.com

| Speaker(s): |

| - Taffi AYODELE - Head, Diverse and Emerging Manager Strategy | OFFICE OF THE NYC COMPTROLLER |

| - Alec LINGORSKI - Managing Director | ALVINE CAPITAL |

| - Paul NEWSOME - Head of Investment Management | UNIGESTION |

| - Chad PIKE - Founder, Managing Partner & Chief Investment Officer | MAKARORA |

| Moderator(s): |

| - Shivani KHANDEKAR - Deputy Editor | REAL DEALS MEDIA |

This summit is by invitation only. However, all LPs are welcome to attend. To reserve a spot, please contact ashling.barry@ipem-market.com

This summit is by invitation only. However, all LPs are welcome to attend. To reserve a spot, please contact ashling.barry@ipem-market.com

| Speaker(s): |

| - Paul ODEFEY - Managing Partner | ALVA CAPITAL |

| - Alex ROSE - Founder and Managing Partner | CATCHMENT CAPITAL |

| - David SANTOS - Founding Partner | ALEOS CAPITAL |

Panel Discussion

This summit is by invitation only. However, all LPs are welcome to attend. To reserve a spot, please contact ashling.barry@ipem-market.com

| Speaker(s): |

| - Francesco ALDORISIO - Partner, Global Head of Private Equity Investments | UNIGESTION |

| - Frank BULMAN - Portfolio Manager and European private equity lead | AWARE SUPER |

| - Wilf WILKINSON - Managing Partner | ACANTHUS ADVISORS |

| Moderator(s): |

| - Claire GUILBERT - Partner, Global Co-Head of Funds and Asset Management | NORTON ROSE FULBRIGHT |

3 x 5min pitching slots

This summit is by invitation only. However, all LPs are welcome to attend. To reserve a spot, please contact ashling.barry@ipem-market.com

| Speaker(s): |

| - Nicholas ANTOINE - Co-Founder & Managing Partner | RED ARTS CAPITAL |

| - Alexandre MARGOLINE - Partner | LAZARD ELAIA CAPITAL |

This summit is by invitation only. However, all LPs are welcome to attend. To reserve a spot, please contact ashling.barry@ipem-market.com

This summit is by invitation only. However, all LPs are welcome to attend. To reserve a spot, please contact ashling.barry@ipem-market.com

This summit is by invitation only. However, all LPs are welcome to attend. To reserve a spot, please contact ashling.barry@ipem-market.com

by StepStone

How does diversified portfolio construction help reduce risk in uncertain times? This interactive session will explore the key building blocks of a private multi-asset class portfolio construction, from foundational principles to implementation. The workshop will take a practical look at how thoughtful diversification and use of private equity and private debt structures can help safeguard investment portfolios in volatile markets to achieve the best risk-adjusted returns, while ensuring regular liquidity to investors.

StepStone Group is a global private markets investment firm with $709 billion of total capital across private equity, infrastructure, private debt and real estate, including $189 billion of assets under management.

| Speaker(s): |

| - Michael ELIO - Partner | STEPSTONE GROUP |

| - Martin PROGIN - Director - Private Debt | STEPSTONE GROUP |

by FTI Consulting

The discussion will identify impacts of cyber-attacks for PE firms based on several real-life experiences and in the context of DORA (Digital Operational Resilience Act) regulation.

| Speaker(s): |

| - Thomas HUTIN - Senior Managing Director & Head of Cybersecurity France | FTI CONSULTING |

by Cathay Innovation

The convergence of crypto and traditional finance is accelerating, bringing speed and efficiency to financial systems, and making them more accessible to people everywhere. Today, blockchain-based platforms allow individuals to access and trade tokenized government bonds 24/7, send and receive payments instantly across borders, and invest in products that offer transparent ownership tracking and automated earnings distribution.

As the boundaries between TradFi and DeFI continue to blur, understanding the implications becomes crucial for investors. Those who subscribe to this shift will be best positioned to lead the next wave of innovation in private markets.

The IPEM Breakout Session is the opportunity to hear from leading banking and asset management institutions embracing the possibilities offered by blockchain technologies to enhance infrastructures and processes, and bring the best products and services to customers. Drawing from the experience of the Cathay Ledger Fund, France’s first alternative fund dedicated to crypto, we will then discuss how to ride the tide of this exciting new era of finance as investors through a picks-and-shovels strategy.

| Speaker(s): |

| - Denis BARRIER - Cofounder & CEO, Cathay Innovation | CATHAY CAPITAL |

| - Arnaud CAUDOUX - Deputy CEO (Finance, risk & IT) | BPIFRANCE |

| - Marc DE KLOE - Partner | THETA CAPITAL MANAGEMENT |

| - Marguerite DE TAVERNOST - Investment Director, Web3 | CATHAY CAPITAL |

| - Benjamin JACQUARD - Operating Partner, FinServ | CATHAY CAPITAL |

by S64

S64 is the home of semi-liquid evergreen private markets funds and is trusted by the world's leading GPs, asset managers, and private banks in EMEA and APAC who rely on S64's cutting-edge technology and unrivalled product manufacturing capabilities to unlock access to private markets.

Join our Founder and CEO, Tarun Nagpal, along with key decision makers for leading private banks and GPs to explore the latest innovations in international private markets democratisation, including the growth of evergreen funds, digital distribution and discretionary solutions.

This lively, engaging session will combine presentations, panel sessions and interactive Q&A.

Speakers will be announced shortly and please register your interest to attend.

| Speaker(s): |

| - Valentin PILLET - Head of Private Assets | SOCIETE GENERALE PRIVATE BANKING |

| - Greta TEOT - Head of Private Markets | MEDIOBANCA |

| Moderator(s): |

| - Tarun NAGPAL - Founder & Chief Executive Officer | S64 |

by Klee Capital & B4Finance

Proven and complementary solutions tailored for private equity professionals to elevate the investor journey — from onboarding to full investment lifecycle management. Trusted by leading firms, they transform regulatory complexity into a frictionless, branded experience that strengthens trust, streamlines operations. Setting a new standard for asset managers’ engagement with their investor community.

| Speaker(s): |

| - Guillaume GOBIN - Deputy Managing Director | KLEE CAPITAL VENTURE |

| - Gabriela PACIU - CEO | B4FINANCE |

by New Alpha Asset Management

Defense is no longer just a state matter – it has become a strategic pillar for European economies and a priority for capital allocation. Rising sovereignty concerns, accelerating public budgets, and the restructuring of supply chains are opening unprecedented opportunities for private investors.

Join us at IPEM Paris for an exclusive roundtable bringing together industry leaders, investors, and strategic experts to discuss:

This discussion will provide unique insights into the structuring of the sector, the companies to watch, and how to invest responsibly and profitably.

A must-attend session to anticipate the transformation of European defense and capture the next wave of investment opportunities.

| Speaker(s): |

| - Walter ARNAUD - Directeur adjoint de la Direction de l’Industrie de Défense | MINISTÈRE DES ARMÉES DIRECTION GÉNÉRALE DE L'ARMEMENT (DGA) |

| - Laurent BOUAZIZ - Head of innovation | ARIANEGROUP |

| - Benoit DE SAINT-SERNIN - Président | CERCLE DE L’ARBALÈTE |

| - Patrick GAILLARD - Cofondateur et directeur général | TURGIS ET GAILLARD |

| - Alexandre PEDEMONTE - CEO - Founder | VISTORY |

What’s next for private capital?

This session explores Transformative Capital—long-term, purpose-driven investment fueling the sectors poised to redefine global growth. Visionary GPs, LPs, and thematic experts will highlight high-conviction opportunities in climate tech, deep tech, healthcare innovation, digital infrastructure, and global resilience.

With Dubai emerging as a global nexus for transformative capital—driven by visionary public-private initiatives, world-class infrastructure, and a bold commitment to future-forward sectors—the session will also examine how regional hubs like Dubai are influencing global capital flows and reshaping investment frameworks.

What are the signals? Where is capital flowing? And how can investors align performance with purpose in an accelerating world?

| Speaker(s): |

| - Simon HARLAND - Deputy Chief Investment Officer | INVESTMENT CORPORATION OF DUBAI |

| - Salmaan JAFFERY - Chief Business Development Officer | DUBAI INTERNATIONAL FINANCIAL CENTRE (DIFC) |

| - Vipul KAPUR - Managing Director & Head of Private Banking | MASHREQ BANK |

by Logical Pictures

With the surge in content demand and the rise of new distribution channels, film and audiovisual financing is emerging as a new asset class in Europe. This session will explore how investors can access the sector through innovative models such as gap financing and equity funds.

Experts from the industry will discuss how risk can be mitigated, how returns can be secured from early revenues, and how portfolios can be structured to balance financial discipline with creative freedom, demonstrating how to bridge the gap between institutional investment standards and the specificities of creative industries.

| Speaker(s): |

| - Nathalie CHOLLET - Head of unit - Circular Economy & Industrial Resilience | EIF - EUROPEAN INVESTMENT FUND |

| - Frédéric FIORE - CEO | LOGICAL CONTENT VENTURES |

Private Capital meets the boxing ring! Join IPEM and our official Wellness Partner Temple | Noble Art for an exclusive no-combat boxing lesson for all levels! With the guidance of a professional boxing champion, you'll learn the moves, hit a bag and enjoy an intense, tailor-made workout.

- No experience necessary: beginners welcome!

- 3 x 50-minute sessions starting at 7:10 AM, 7:20 AM, and 7:30 AM

- Limited groups for personalized coaching

- Fully privatized club for IPEM participants

- All you need to bring is your sportswear, boxing gloves will be provided

- Premium changing rooms: individual showers, lockers, towels and cosmetics.

- 1 minute walk from the IPEM Paris venue, the Palais des Congrès

Open to all IPEM Paris 2025 participants, registration required.

An exclusive, invitation-only breakfast welcoming first-time LP and GP attendees. Connect in a relaxed setting with fellow newcomers before the day begins.

Location details will be shared privately with confirmed guests

Keep the conversation flowing after a busy day with a refreshing glass in hand

An exclusive, invitation-only dinner bringing together IPEM attendees for an evening of networking and conversation in an intimate setting.

Location details will be shared privately with confirmed guests.

Join all IPEM participants for a night our on the town, Paris style! We're heading to the charming neighborhood of Saint-Germain-des-Près in Paris' 6th arrondissement, where IPEM is taking over one of the locals' favorite streets rue Princesse. Join us for an evening of bar-hopping and networking.

Chair’s Welcome Remarks

| Speaker(s): |

| - Gui COSTIN - Founder & CEO | DAKOTA |

Traditional asset managers continue to build out their private markets franchise at pace. Of the $72trn managed by the top 25 traditional asset managers, $4trn is now in private markets. Whilst some continue to hunt for deals, others are sticking to their roots - looking to increase access to private markets through low-cost products. What’s the outlook on M&A strategy? Can traditional managers be major market consolidators? What are the advantages to private alternatives of being part of a heritage brand in public markets? What’s the future role of private markets within the stable of the big players?

| Speaker(s): |

| - Emmanuel DEBLANC - Chief Investment Officer, Private Markets | M&G INVESTMENTS |

| - Isabelle SCEMAMA - Global Head of AXA IM Alts | AXA IM ALTS |

| Moderator(s): |

| - Selin BUCAK - Journalist & Editor | CITYWIRE |

Nowadays, everyone has a watchlist. LPs that have expanded into direct and co-investments have long built the internal skill sets to analyse deals. In a tough environment for funds, plus more single asset CVs, this expertise is being put to the test. Even for fund investors, deeper portfolio analysis of top performing companies is making it easier to build target lists for attractive co-investment opportunities. Is there such a thing as proprietary deal sourcing anymore? How can LPs partner with GPs on deals? What does value-adding origination look like in practice?

| Speaker(s): |

| - Adel ALDERBAS - Chief Investment Officer | WAFRA |

| - Alper DAGLIOGLU - Managing Partner and Head of Investment Solutions Group | BROOKFIELD |

| - Claire GAWER - Head of Fund Platform | BNP PARIBAS ASSET MANAGEMENT - PRIVATE ASSETS |

| - Albrecht VON ALVENSLEBEN - Head of Private Equity Europe | LA CAISSE |

| Moderator(s): |

| - Swetha GOPINATH - Private Equity Reporter | BLOOMBERG NEWS - LONDRES |

Co-investments have often been presented as a means to bring down the cost of private market investing. But with dedicated resources, knowledge and expertise required, they weren’t open to all. Now, in the current market environment, they look more of a necessity; providing apast way for LPs to deepen GP partnerships and gain access to attractive dealflow. Have co-investments really addressed the cost issue? What about monitoring, transaction and other costs? How can co-investment be made easier to access for a wider range of investor?

| Speaker(s): |

| - Alvaro GONZALEZ RUIZ-JARABO - Head Private Equity | ANDBANK ACTYUS |

| - Marie PESTALOZZI - Co-Head Private Equity Investment Team | AMUNDI ALPHA ASSOCIATES |

| - Joana ROCHA SCAFF - Managing Director, Head of Europe Private Equity | NEUBERGER BERMAN |

| - Koen RONDA - Head of Private Markets Investments | IBS CAPITAL MANAGEMENT |

| Moderator(s): |

| - Leanna REEVES - Private Credit Reporter | OCTUS |

The secondary market is set to break more records, with volumes heading towards $200bn this year. It’s fast growth points towards the active trading of a large portion of fund stakes. Is there a scenario where secondary overtakes primary activity? Can the market evolve away from an intermediated (and expensive) market? At what point does that approach reach its limits and need of a revamp?

| Speaker(s): |

| - Gabriel MOLLERBERG - Managing director in the External Investing Group (XIG) | GOLDMAN SACHS ALTERNATIVES |

| - Verdun PERRY - Sr. Managing Director, Strategic Partners | BLACKSTONE |

| Moderator(s): |

| - Madeleine FARMAN - Editor, Secondaries Investor | PEI GROUP |

Secondaries or not? Fig leaf hiding overpriced assets or genuine gem in the rough? Continuation funds are the subject of increasing debates. Besides the thorny question of valuations and conflicts of interest management, the real question is: why do we need them? There are plenty of solutions, chiefly secondary LBOs, that would address the issue of lingering assets in portfolios. Why do fund managers hang on to them? Is it that difficult to source good deals? Do managers fall in love with assets and struggle to let go? Is this all for IRR enhancement in light of a disappointing course of action?

| Speaker(s): |

| - Fred EBRAHEMI - Partner, Chief Operating Officer & General Counsel | CLEARLAKE CAPITAL GROUP |

| - Cyndi MOSQUERA - Director | METLIFE INVESTMENT MANAGEMENT |

| - Christophe NICOLAS - Managing Director | ALPINVEST |

| Moderator(s): |

| - Ana DICU - Managing Director | CAMPBELL LUTYENS |

When it comes to fiduciary duty, it’s essential for investors to walk the walk on sustainability. PGGM is implementing a fully integrated philosophy based around financial returns, risk and sustainable impact. The aim is to give the investment manager a three-dimensional perspective on every investment in every asset class across its EUR250bn portfolio. In this presentation, Lars explains the reasons why, the strategy and lessons learned.

| Speaker(s): |

| - Lars DIJKSTRA - Chief Investment Officer (CIO) | PGGM |

"Evergreen” vehicles have rapidly gained the attention of institutional LPs, whose appeal for semi-liquid structures may easily be equivalent to that of the private wealth investors they were designed for. This panel will discuss:

| Speaker(s): |

| - Richard HOPE - Co-Head of Investments | HAMILTON LANE |

| - Cara HUBBARD - Investment director | WELLINGTON MANAGEMENT |

| - Shenal KAKAD - Head of SSG Private Markets | BARCLAYS WEALTH AND INVESTMENT MANAGEMENT |

| - Emily POLLOCK - Director, Private Equity Product Strategies team, Global Client Solutions | KKR |

| Moderator(s): |

| - Alexander SCHOENFELDT - Head of Investments | LUMYNA INVESTMENTS LIMITED |

The AI revolution isn't coming—it's here, and it's accelerating faster than most predicted. As models leap from impressive to genuinely transformative, private market investors are riding the wave right across the spectrum of asset classes and strategies. From cloud infrastructure and data centres, to the applications reshaping industries, this session provides an update on market trends and where value lies.

| Speaker(s): |

| - François CANDELON - Operating Partner | SEVEN2 |

| - - | |

| - Astrid MOULLÉ-BERTEAUX - Vice President | HEADLINE |

| - Lauriane REQUENA - Director, Tech Growth | KKR |

| Moderator(s): |

| - Andrew WOODMAN - London Bureau Chief | PITCHBOOK |

So far, building an investable passive private market index remains elusive. Yet the proposition is attractive, as if investors could "buy the market", they would not lose capital. This proposition is compelling given the difficulty in selecting funds and the wide dispersion of performance. As private markets continues to grow, and more liquid markets are created, how might the convergence between public and private create an environment for new ways to gain exposure to the industry?

Why is this so difficult? Is this even possible? What would be the required conditions to see the emergence of such a product? Who would be the most legitimate type of actor to create such a product? Who would be the core client group for such a product?

| Speaker(s): |

| - Benedetta BALDUCCI - Managing Director Private Markets EMEA and APAC | STATE STREET INVESTMENT MANAGEMENT |

| - Matt DOUGLASS - Head of Private Credit | PGIM |

| - Mark O'HARE - Vice Chairman and Co-Founder of Preqin | PREQIN, A PART OF BLACKROCK |

| - Alessandro TAPPI - - | EIF - EUROPEAN INVESTMENT FUND |

| Moderator(s): |

| - Nicholas SMITH - Managing Director, Private Credit | ALTERNATIVE CREDIT COUNCIL |

Private wealth has long been regarded as a complex, sub-scale and difficult source of capital. The potential is big, but the road is long. To win the long game, what hurdles must the industry overcome to achieve widespread adoption? And how fast will this happen?

| Speaker(s): |

| - Charles FOUCARD - Chief Operating Officer | EDMOND DE ROTHSCHILD PRIVATE EQUITY |

| - Teena JILKA - Private Markets Investment Adviser | MERCER |

| - Julia LUNDSTRÖM - Client Solutions, Head of France & Benelux, Senior Vice President | ICAPITAL |

| - Raphaela SCHRÖDER - Co-Founder and CEO | AUREA PARTNERS |

| Moderator(s): |

| - Philipp BUNNENBERG - Head of Alternative Markets | BAI E.V. |

Private markets have a knack for reinventing themselves. What has been the key takeaways from IPEM Paris 2025.

| Speaker(s): |

| - Fabio OSTA - Head of Alternatives Specialists EMEA Wealth | BLACKROCK PRIVATE EQUITY PARTNERS |

| - Jim PITTMAN - Executive Vice President & Global Head, Private Equity | BRITISH COLUMBIA INVESTMENT MANAGEMENT CORPORATION |

| Moderator(s): |

| - Antoine COLSON - CEO | IPEM |

Concluding remarks to summarise key takeaways.

| Speaker(s): |

| - Antoine COLSON - CEO | IPEM |

Opening remarks to set the scene on private debt’s evolution.

| Speaker(s): |

| - William COX - Senior Managing Director | KBRA |

Some of the largest leveraged buyouts (LBOs) in the last two years have been financed by private credit. For those lending to large-cap global businesses, speed to market is vital in completing deals when billions of dollars are at stake. Some of the industry’s mega funds are pushing direct lending activity further into the broadly syndicated loan space - the long-held preserve of global banks - such is the size of the loans being underwritten. As direct lending deals grow bigger, and GPs respond ever faster to demand by underwriting entire loans (unitranche loans), how is this likely to shape the future of corporate lending? As banks arrange syndicated loans, will they look to develop more hybrid structures with credit managers to share the risks, or will they follow JP Morgan and raise the competitive stakes?

| Speaker(s): |

| - Tristram LEACH - Partner and Co-head of European Credit | APOLLO |

| - Tara MOORE - Managing Director, Head of European Originations | GOLUB CAPITAL |

| - Matt THEODORAKIS - Partner and Co-Head of European Direct Lending | ARES MANAGEMENT |

| Moderator(s): |

| - Louis THUILLEZ - Managing Director | AETHER FINANCIAL SERVICES |

Direct lenders have established themselves as the de facto financing partner for mid-market sponsors. Their speed, certainty and flexibility means they’re now essential grease on the wheels of the transaction market. But how do direct lenders sustain a pipeline in another challenging year for sponsor-backed M&A? How do debt platforms navigate this era of geopolitical shocks to stay resilient? Are the fortunes of debt funds and financial sponsors intrinsically linked?

| Speaker(s): |

| - Jens BAUER - Managing Director and Co-Portfolio Manager | OAKTREE CAPITAL MANAGEMENT |

| - Nicola FALCINELLI - Managing Director - Partner, Deputy Head of European Private Credit | CARLYLE |

| - Klaus PETERSEN - Founding Partner | APERA ASSET MANAGEMENT LLP |

| - Orla WALSH - Head of Europe Private Credit Portfolio Management | BARINGS |

| Moderator(s): |

| - Lucia CAMBLOR - Chief Credit Correspondent | OCTUS |

In an increasingly competitive market, lenders in Europe’s lower middle market must sharpen their sourcing strategies and deal structuring techniques to secure the best opportunities and stand out to borrowers. Unlike the upper market, where scale and brand recognition often drive deal flow, lower middle market lenders must rely on a combination of deep market intelligence, strong local networks, and creative structuring to originate and execute high-quality transactions. Success in this space is less about waiting for deals to come to you and more about tracking the right borrowers, understanding their needs, and moving swiftly when the right opportunity arises. Just like a skilled hunter, lenders must stay agile, anticipate shifts in the landscape, and use the right tools—whether proprietary data, sponsor relationships, or bespoke financing solutions—to capture the best deals before the competition does.

| Speaker(s): |

| - Aris CONSTANTINIDES - Managing Director in the Growth Debt team | BLACKROCK GROWTH DEBT |

| - Richard DALAUD - Managing Partner Siparex Mezzanine - Member of the Executive Committee | SIPAREX |

| - Xavier DE PRÉVOISIN - Managing Partner | MBO+ |

| - Eric GALLERNE - Managing Partner - Private Debt | EURAZEO |

| - David MERRIMAN - Partner, Head of Private Debt | BEECHBROOK CAPITAL |

| Moderator(s): |

| - Rachel MCGOVERN - Managing Director | KBRA DLD, A DIVISION OF KBRA ANALYTICS |

With Europe’s net-zero transition requiring an estimated €29 trillion ($32 trillion) in cumulative investment by 2050, and annual funding needs rising from €680 billion to €1.04 trillion, private markets—particularly private credit—have a critical role to play. As banks pull back from riskier lending, private credit managers are stepping in to finance companies on their energy transition journeys, leveraging flexible capital to drive sustainable outcomes. Innovative mechanisms like ESG margin ratchets, which link borrowing costs to specific sustainability performance criteria, are already in play—but what’s next? Beyond pricing incentives, how are private credit managers integrating ESG into underwriting, due diligence, and portfolio management? And as regulatory frameworks evolve, will ESG considerations become a fundamental pillar of private credit investing or remain a secondary feature in deal structuring?

| Speaker(s): |

| - Adrien DESBOIS - Investment Manager | EIF - EUROPEAN INVESTMENT FUND |

| - Alexandra TIXIER - Co-Head Sustainable Private Credit, Lead Impact Private Credit | ALLIANZ GLOBAL INVESTORS |

| - Nicole WAIBEL - Managing Director | CRESCENT CAPITAL |

| Moderator(s): |

| - Xavier LEROY - Member of the Executive Committee - Head of Advisory Services | ETHIFINANCE |

Concluding remarks to summarise key takeaways from the morning sessions.

Lunch

How is the market evolving for more flexible credit solutions.

| Speaker(s): |

| - Maxime LAURENT-BELLUE - Deputy CEO and co-head of Credit | TIKEHAU CAPITAL |

In an ever-expanding universe, one challenge for LPs is taking a holistic view on private debt portfolio construction. How do LPs capitalise on opportunities that don’t quite fit the mould?

| Speaker(s): |

| - Marie BURSAUX - Director Private Debt | EIFFEL INVESTMENT GROUP |

| - Olivier CASSIN - Managing Director, Head of Investments and Research | BFINANCE |

| - Lucas PECH - Investment Director | LOMBARD ODIER |

| - Jakob SCHRAMM - Partner & Head of Private Credit | GOLDING CAPITAL PARTNERS |

| Moderator(s): |

| - William BARRETT - Managing Partner | REACH CAPITAL |

Tactical opportunities funds, a hybrid strategy that bridges the gap between private credit and private equity and seeks to capitalise on underserved or complex areas of the corporate market, are on the rise. With the flexibility to underwrite across the capital structure, what does this look like from an origination, underwriting and returns perspective?

| Speaker(s): |

| - Philip CUFF - Partner, Head of Hybrid Equity Europe | APOLLO |

| - Raphael DE BOTTON - Senior Managing Director, Tactical Opportunities | BLACKSTONE |

| - Saam GOLSHANI - Head of PE Practice and FRI | WHITE & CASE |

| - Owain GRIFFITHS - Partner & Head of Capital Solutions | SONA ASSET MANAGEMENT |

| Moderator(s): |

| - Lisa LEE - Managing Editor, Creditflux (part of Debtwire) | ION ANALYTICS |

Distressed investing has come a long way since the Global Financial Crisis. Back then, widespread market dislocation and liquidity constraints presented a rich opportunity set.

Nowadays, deeper private credit markets can provide funding solutions to companies with complex credit profiles before they become stressed.

| Speaker(s): |

| - Mathieu CLAVEL - Portfolio Manager, Alternative Credit | PIMCO |

| - Josefa LLINARES - Head of Origination | POLUS CAPITAL MANAGEMENT |

| - Michel LOWY - CEO / Co-Global Portfolio Manager | SC LOWY |

| - Musa SONMEZ - Co-Head of Europe & Partner | OAK HILL ADVISORS |

| Moderator(s): |

| - You-Ha HYUN - Principal, Head of Private Debt | PERPETUAL INVESTORS GMBH |

Opening remarks to set the scene on structured credit and specialty finance.

| Speaker(s): |

| - Thomas SPELLER - Senior Managing Director, Global Head of Fund Finance | KBRA |

As direct lending matures, investors are branching out into niche strategies such as asset-based lending, litigation finance, Net Asset Value (NAV) lending, and royalty financing. This trend is creating opportunities for new managers to differentiate themselves in the market. The outlook for ABF is promising, with the market expected to grow from $5.2 trillion to $7.7 trillion by 2027. The pullback of traditional lenders in response to regulation and the outbreak of volatility in the banking system are all likely to increase the need for private ABF so how are firms tapping in to this growing trend?

| Speaker(s): |

| - Kyle ASHER - Managing Director & Co-Head, Alternative Credit Solutions | MONROE CAPITAL |

| - Doug CRUIKSHANK - Managing Partner & Founder | HARK CAPITAL |

| - Peter HUTTON - Head of NAV Financing | ARCMONT |

| Moderator(s): |